How To Invest In Secondary Markets From A Distance With Kimberly Kesterke – Real Estate Women

Distance should never be a barrier to building a successful real estate portfolio. With effective processes and a strategic approach, anyone can achieve financial independence through real estate investing. In this episode, Kimberly Kesterke, Founder of The W2 Landlord Community, discusses how to invest in secondary markets from a distance. She shares her expertise in managing a rental portfolio from a distance. With years of experience and effective processes, Kimberly has built a six-figure cash flowing rental portfolio while working a full-time job and raising a child. She shares her real estate journey, how she achieved this, and now coaches others to invest in real estate aligned with their strengths and minimize evictions and vacancies. Tune in and learn all about secondary markets to start your real estate journey now.

—

Watch the episode here

Listen to the podcast here

How To Invest In Secondary Markets From A Distance With Kimberly Kesterke – Real Estate Women

Real Estate Investing For Women

I am so excited to welcome the show Kimberly Kesterke. Kimberly is the Founder of The W2 Landlord Community and has many years of experience managing her rental portfolio from a distance. Kim built a six-figure cashflowing rental portfolio all while working at a full-time corporate sales job, raising a daughter, and managing our properties herself. Through that experience, Kimberly has created effective processes that resulted in only one eviction during the years and very few vacancies.

In 2019, she finally hired a property manager and, in 2020, started a Facebook community with four real estate investors with full-time jobs. Finally, in 2022, she quit her corporate sales job in order to focus on her real estate business full-time. That’s so exciting. She now works with coaching clients to help them build foundations in place to hit their financial independence goals and confidently invest in a real estate strategy that aligns with their strengths. Kim, welcome to the show.

Moneeka, it’s so good to see you.

It’s good to see you again. We’ve been on a couple of other panels together with real estate organizations, so it’s so much fun to finally have Kim meet you ladies and get to share her with you. Thanks, Kim.

Thank you.

Kim, it’s impressive that you have quit your job and now you’re fully into real estate, but how did you get started?

I got started back in 2006. I purchased my first home. If you remember that time, it was such a buzz. It was the responsible thing to do. Everybody was buying a house whether we had money or not. I was about 25 years old at the time, and I purchased my first property in Augusta, Georgia. That’s where I was living. I was working there.

Fast forward to 2008, we all know what happened. The economy crashed and at the same time was transferred to the Atlanta market, which is about three hours away from Augusta, for my sales job. I became an accidental landlord at that time. I decided to put tenants in place, rent the property, and managed everything from a distance, which back then it was unheard of to coordinate everything via phone and email, and not be onsite for all of those tasks and things.

I started to gain confidence. Over the years, I started acquiring a duplex here, and a triplex there and started building my portfolio. When 2019 came along, I decided to hire a property manager. I had about eighteen units at the time, and that’s how I got started. Consistency is what helped me build my portfolio over time.

Are all of your properties in Augusta, then?

Not anymore. Originally they were, but then as I started learning different strategies and investments, I branched out to other markets. I have properties all over. I have one in New York and a couple in North Dakota. In terms of managing secondary markets, I’ve expanded my portfolio that way.

How did you hire a property manager? Do they do everything remotely?

The property manager that I have is for my Augusta units. That’s where a bulk of my units are, and then the other properties that I own, I self-manage.

Talk to us about how you define a secondary market.

I define a secondary market as a market that is typically about 150,000 in population. It may have 3 to 5 industries within that market. What that tells me is that there’s a lot of support in that economy that would support people to move in, to rent, to buy all of those different things. In a secondary market, I also take a look and make sure that it’s a place that people want to live and that people would want to move to.

The reason why I look at 3 to 5 industries is because you don’t want to put all of your eggs in one industry. For instance, if that corporation or whatever that industry is, because every market is different, leaves, you don’t want to be caught with a property that depreciates very quickly. Those are some of the key things that I look for.

Don’t put all your eggs in one industry. Every market is different, and you don't want to be caught with a property that depreciates very quickly. Share on XHow do you find those markets?

There’s a variety of different ways. There’s a free tool that I use online called NeighborhoodScout. Let’s say I’m reading an article online, and it says, “Top 50 best places to invest.” I see that all over the place all the time. If I’m curious about it, I’ll go on to NeighborhoodScout. It’s a free tool. I’ll poke around, I’ll put the city in, and I’ll start looking at the different things to see if it’s a place that I’d want to dive in deeper and actually invest.

Why did you decide to do secondary markets?

I stumbled upon it with Augusta. Augusta, Georgia, is a secondary market. As I was building my portfolio, I looked around at all of the competition that a primary market brings, whether it’s hedge funds moving in or it’s a lot of investors competing for the same properties. Also too, for me, the secondary market fit my budget personally because I was at the time doing conventional loans that would be 20% down after you get a certain amount under your belt.

The price tag was a lot more attractive to me. It turned out that what I was putting in as a down payment to what the rents were worked out where I was still cashflowing, still making money, still getting the appreciation. It may not have been as broad as the Atlanta market, for example, but it was where I could afford it. I could continuously do it and still see good results.

You fell into that. How would you say other people can get started in a new market?

If there’s a market that somebody hears about or there’s a lot of buzz or maybe it’s not so much buzz, but they personally know a family that lives there who knows a little bit about it, then I would say start doing your research. The question is, “How do I research if I live half a country away?” Basically, what I said a little bit earlier is I’ll go on NeighborhoodScout.com. It gives a lot of information in their free tool.

I’m not affiliated with it. That’s what I’ve used. You can drill into different ZIP codes, you can check crime rates, where the industries are, or what kind of industries. You can then take that information, walk over to Zillow, and then start seeing what the rents are. If it’s starting to look like a market that matches the type of tenant avatar that you’re renting to or if it’s matching all of the different check boxes that you have, then it’s one to start exploring further by calling some property managers or getting on the local city Facebook group and start diving in that way.

Talk to me a little bit about calling property managers. I’ve heard that before. It’s a great tool to utilize and get to know new markets. Tell me a little bit about how you managed that process.

I personally did this for a property that I was looking at in Port Charlotte, Florida. I ended up buying it. I had never been to Port Charlotte. I love the area now, knowing more about it. What I did before I put an offer in and closed on the property was I called a couple of property managers and gave them the details of the property. I said, “This is it. This is what I’m thinking of renting it at. What are your thoughts?” They gave some good advice.

I was even looking at renting a little bit lower than I should have, which was nice. I was able to up my rate and learn a little bit more about how snowbirds are coming down. It’s more information than I ever would’ve known. If you think about it, property managers are going to obviously know the area because they have dozens, if not hundreds, of properties that they’re managing. If they understand who you’re renting to and what your investment strategy is, they can give you good advice.

Secondary Markets: Property managers are going to obviously know the area because they have dozens, if not hundreds, of properties that they’re managing. If they understand who you’re renting to and what your investment strategy is, they can give you good advice.

Do you ever feel obligated to hire them?

If I personally buy there, then yes, I would because it’s a fair exchange that way.

With that Florida property, did you hire a property management company?

Yes. We ended up hiring that property management.

What strategies would you say work well for managing at a distance? For some of the properties you have a property manager, but what are some of your strategies for being far away and still managing properties?

For my rentals, where it’s more of a landlord-tenant relationship, long-term rental, those properties are managed by a property manager. I also have another strategy in place where I will acquire a property and then I’m, in essence, the bank. What I’ll do is I’ll buy the property and sell it either with rent-to-own terms and/or, depending on what price, I get that property seller financing, where it might be a land contract or land installment contract for deed. I’ve done a lot, a wide variety of different ones. I’ve even done a seller finance where, at the closing table, the deed transfers.

There are a lot of different ways that you can do it. What I like about that and why I think it’s very attainable to invest in secondary markets anywhere is you don’t have to do the maintenance. You’re, in essence, the bank. The biggest thing you’ve got to make sure of is you collect the payments, and there are loan servicing companies that can do that. They’re only $10 to $15 a month. It’s one of those things that if you’re looking for creative ways to get out of your market but don’t want all the hassle of the maintenance and the risk, selling properties as the bank is a good way to go.

That was a lot of information. First of all, with the loan servicing companies, if they need to collect late rent or anything like that, do they charge extra or is it that flat fee?

Yes, you have to put your terms upfront, whatever your terms are. If it’s after the fifth you collect 10%, you’ve got to give them that, but that is how they process it.

What happens if someone doesn’t pay?

It depends on how you structure it. If you structure it more in a contract-for-deed format where the deed transfers after everything is paid off, then you can go through an eviction process. You don’t necessarily have to foreclose. If you structure the deal that the deed transfers at closing, then you would have to go through a foreclosure. Keep in mind that every state is different. If this is something you’re interested in, talk to your local title agency or your real estate attorney and understand what works for your state because everybody’s slightly different.

When you mentioned that there were several different ways to be the bank, you mentioned three right off the top of your head. I understood everything you said, but most of my readers probably will not. Can you take that down a little bit more?

The first one is contract per deed. I like that one because if you imagine somebody goes and gets a car loan, you don’t get the title of the loan until you pay it off. Basically, that’s what you’re offering as the seller. You don’t transfer the deed until it’s paid off. You could amortize that for 30 years, 15 years, or whatever you want to do. The deed transfers after the fact. What’s nice about that strategy is that you get a lot of tax benefits. You get good cashflow. There are some good strategies for that. That’s one of them.

Secondary Markets: A contract per deed is a nice strategy that allows you to get a lot of tax benefits and good cash flow.

Do you take a down payment for that one?

I do.

Do you have an idea of the percentage of what you take, or is it a flat rate? What do you normally do about that?

What I do personally is 10% down. I’ve tried a wide variety of different ones. I’ve done, depending on the area, $2,000 down. I’ve done a wide variety. A 10% down, I believe, attracts a person that wants a loan or a mortgage and is going to pay on time. It’s a good qualifier, in my opinion.

You’re the rent to own. They’re paying principal and interest. What kinds of rates do you normally charge?

It all depends. Usually, I take what the prime is and add a couple of points to it because there is a premium to being able to offer the terms. If they could go down and get a conventional loan, then go get the conventional loan. As the investor, we’re taking on a little bit more of the risk, so we can charge a little bit of a higher interest rate.

Now go to the second strategy.

The land installment is another way of saying contract for deed. That’s how I clump those two together. The rent to own, that one’s a pretty cool, unique way to do it because you collect a non-refundable option fee upfront. What that is, is that is also a down payment but non-refundable. It will go against the final principal. At the same time, as an investor, you can manage the monthly payments any way you want. It’s not a straight amortization like a contract for deed or land installment. A rent to own, you can charge the rent and then, as the investor, you can choose how much that rent payment goes towards the principal.

At the very end, they have what we term a balloon payment, and the non-refundable option fee is obviously taken out of that principal. Whatever you decided as the investor with the tenant-buyer, how much each month was going to be applied to it. Rent to own is a cool strategy because there are a lot of exit strategies. They can cash you out after 2 to 4 years. You can redo the lease for another 2 to 4 years, however long you want, and then negotiate with them how much of that payment is actually going to the principal.

The contract to own and the rent to own are similar, but there are some subtle nuances it feels like. Is that true?

It is. It all depends on what your comfort level is, your state, and what the different rules are for evictions and contracts. I’m operating where I operate. The rules could vary. Understanding your specific areas is what my advice would be.

Understand your specific areas. In real estate, operations can depend on your comfort level, your state, and what the different rules are for evictions and contracts. Share on XIf you were starting all over, what would you do?

I love that question because I did a Facebook Live about that. When you look at the way that the economy is now, it’s completely different than what it was from 2006 to 2008. You could get conventional loans at very low-interest rates. Nowadays, what I personally would do is I would purchase a property, and I’m doing this right now, and I would basically flip it without doing much of anything. What I’m doing is I’m flipping the paper. I’m offering either contract for deed, I’m offering rent to own, and then I’m holding that property as long as I can in those specific terms.

What I like about that is, especially where I came along in my investing journey, I like to take a more conservative approach. I guess I’m boring that way, but I like the conservative consistency. In this approach, you know what your cashflow’s going to be on a monthly basis as long as they pay. There are alligators in every water, but let’s say they always pay, you’re getting that cashflow and maintenance isn’t eroding your profits. That’s a great way for people to start and understand real estate investing.

What kinds of properties are you buying, or how are you finding the properties?

I’ve found them in a variety of ways. Now, where I’m getting my properties is I’m sending out letters to sellers and people who own the property but don’t live in the property. I’m sending out letters on this is what I can offer and what I’ve been slowly acquiring but acquiring them that way.

How are you determining the sale price for the properties?

It’s a combination in terms of what I’m selling after I buy it. It’s a combination of looking at the comps and also knowing that I’m also providing a premium for people to purchase, not having to go to the bank. I’ll take a look at comps and pretty much price it where I’m still making some profit, but it’s still within line with what the local comps are.

Let’s say, for instance, you have a contract that’s five years and you’re selling this property with a five-year contract. In five years, that property would’ve appreciated. You’re basically giving up that appreciation in favor of a little bit of a higher interest rate. Is that what I’m hearing?

Not entirely. It’s what is reasonable. Let’s take the Florida property, for example. Looking at the local comps, the higher comp was around $600,000. What my business partner and I did was we took a look at it and we’re like, “Let’s price it more around $599,000. Let’s see if we get some interest.” We got a tremendous amount of interest. We were able to purchase it at a lower price, the way that we were able to work with the seller and work with the wholesaler that brought that property to us. We still made a profit that way.

In that sense, you never know what’s going to happen in five years. You could say you are foregoing some appreciation for the higher interest rate, but we still ended up making money. It was one of those win-wins where we were making money. We were able to get a tenant buyer that was happy with it and, at the same time, everyone is winning out of the situation.

You quit your job to go full-time into real estate. We’re going to talk about this in a deep dive in EXTRA, but could you give us a high level of what it took for you to make that transition? I know so many of my ladies want to make that transition but don’t even know it’s scary. How do you get started even thinking about that?

For the record, maybe because I’m a slow learner, it takes me a while. It took me two years after I decided I wanted to do it. The reason why is because I put some processes in place. I wanted to put some goal marks in. I wanted to hit certain things before I felt that I would be ready to leave my corporate job. I was doing well, and it was something that I wanted to do in real estate full-time. That’s where I was at.

What I ended up doing is I first took a look at my portfolio in its entirety. I took a look to see which ones are the more profitable ones and which are not. I sold the ones that were lagging a bit, the 1031 exchange into some higher profitable property. That took a little bit of time. I had to take a look at what my true expenses were.

Not the bottom of the barrel if I’m surviving expenses, but I wanted to know what does my life cost when I’m doing the things I want to do and going where I want to go. I’m living feeling free and abundant. I wanted to know what that number was and then I wanted to make sure that my cashflow either hit that or was there enough that if I had to do some active income, I still was living the life that I wanted to live. There are more things that I did, but those were two major things I wanted to make sure happened before leaving.

Secondary Markets: Be aware of the cost of doing the things you want to do and going to where you want to go. Make sure you’re aware of the costs and benefits, and if it’s enough, before you proceed.

All that prep and stuff, we are going to talk about that in EXTRA, and I’m excited about that. Nobody’s talked about that on that show. We’ve met a lot of people that made that transition, but they haven’t talked about that process that actually happens between being a W-2 employee and being a real estate investor. I’m super excited about that. We will talk about that in EXTRA. This has been awesome. Is there anything else you want to share that I haven’t asked about?

If people want to get in touch with me, I do have a free Facebook group. It’s the best place to go and have investing conversations with other people that have full-time jobs. It’s called Real Estate Investors with Full-Time Jobs at Facebook. I wanted to make it obvious. That’s the name of the group. They can also come to my website, TheW2Landlord.com. I’ve got different resources up there as well.

Thank you so much for that. Are you ready for three rapid-fire questions?

Yes, absolutely.

Tell us a super tip on getting started investing in real estate.

I would say don’t overanalyze because taking action and jumping in sometimes is the better way to go. What I love about real estate is there are dozens of exit strategies that even if you feel your plan A isn’t working out the way you wanted it, there are a lot of different ways that you can still monetize and earn a profit on that deal.

What would you say is one strategy to be successful as a real estate investor?

I would say consistency. It’s not always about the big home runs. A lot of times, it’s about taking a deal that you know you’re going to make money on and letting that be okay. It doesn’t necessarily have to be the big grand slam because you’ll get those from time to time. Like in corporate sales, you always get those big sales, but it’s the small and consistent wins that help you build your portfolio and your net worth.

Like in corporate sales, you always get those big sales, but it's the small and consistent wins that help you build your portfolio and your net worth. Share on XWhat is one daily practice that you do that you would say contributes to your success?

I’m constantly networking, and I think that the group helps. When I say networking, it doesn’t necessarily have to be sending DMs. It’s more about being on the Facebook groups, dropping if there are questions, and answering them. Maybe you see somebody who’s a lender. I had a conversation with somebody who lends in all 50 states. We ended up having a good conversation on the phone. It’s connecting with people. You never know who’s going to approach you with an opportunity or you might even be able to help them and send them a lead. This particular business is such a win-win industry if we’re all supporting each other.

This has been amazing. Thank you so much. You gave us so much information in this bite-sized episode. I loved that. Thank you.

Thank you. This has been great, Moneeka. I’m glad that we were able to connect, and thank you for the invite.

Thank you for joining Kim and I for this portion of this show. We’ve got more right on EXTRA. We’re going to be doing a deep dive on how to prepare for that exit out of your full-time job into becoming a real estate investor full-time. What’s fun about becoming a real estate investor full-time is that it’s not full-time. You get so much time freedom once you make that transition. We’re going to be talking about exactly how Kim did that, from her high-paying corporate job to real estate investors. We’re going to do that in EXTRA.

If you are subscribed already, stay tuned. If you’re not and would like to be, go to RealEstateInvestingForWomenEXTRA.com and you can subscribe there. For those of you that are leaving us now, thank you so much for joining us. I look forward to seeing you next time. Until then, remember, goals without action are dreams. Get out there, take action, and create the life your heart deeply desires. I’ll see you soon.

Important Links

- The W2 Landlord Community

- NeighborhoodScout

- Real Estate Investors with Full-Time Jobs – Facebook

- RealEstateInvestingForWomenEXTRA.com

Get Dr. Shaler’s free EBook: “How to Spot a Hijackal” at https://www.forrelationshiphelp.com/help-handling-hijackals-spot-signup/

To listen to the EXTRA portion of this show go to RealEstateInvestingForWomenExtra.com

——————————————————

Learn how to create a consistent income stream by only working 5 hours a month the Blissful Investor Way.

Grab my FREE guide at http://www.BlissfulInvestor.com

Moneeka Sawyer is often described as one of the most blissful people you will ever meet. She has been investing in Real Estate for over 20 years, so has been through all the different cycles of the market. Still, she has turned $10,000 into over $5,000,000, working only 5-10 hours per MONTH with very little stress.

While building her multi-million dollar business, she has traveled to over 55 countries, dances every single day, supports causes that are important to her, and spends lots of time with her husband of over 20 years.

She is the international best-selling author of the multiple award-winning books “Choose Bliss: The Power and Practice of Joy and Contentment” and “Real Estate Investing for Women: Expert Conversations to Increase Wealth and Happiness the Blissful Way.”

Moneeka has been featured on stages including Carnegie Hall and Nasdaq, radio, podcasts such as Achieve Your Goals with Hal Elrod, and TV stations including ABC, CBS, FOX, and the CW, impacting over 150 million people.

How To Generate Passive Income Without Quitting Your W-2 Job With David Vernich

Generating passive income does not only mean earning money without playing an active role in your investment. This will also allow you to keep your W-2 job, giving you multiple income sources. To discuss how to do this the right way, Moneeka Sawyer sits down with David Vernich. He shares how he got proper mentorship to get into real estate, borrowed money from a banker, and started renovating homes and building family rental properties, all while continuing with his regular day job. David also discusses their partnership program, where he helps other aspiring real estate investors emulate the same strategy he did when he began.

—

Watch the episode here

Listen to the podcast here

How To Generate Passive Income Without Quitting Your W-2 Job With David Vernich

Real Estate Investing For Women

I am so excited to welcome the show, David Vernich. As a banker for many years, David has loaned money to all kinds of businesses, but one stands head and shoulders above all the rest to generate passive income through real estate investing. Several years ago, David sought a mentor to teach him how to invest in real estate and found the perfect husband and wife team to show him the ropes.

After doing one single-family flip and coming to the realization that finding and fixing up houses was not something he enjoyed, David pivoted to a team approach. Using his financing expertise, he became the guy to firm the purchases and renovation for starter homes to build passive income for the whole team and share in the many benefits of owning 1 to 4-family rental properties. Welcome to the show.

Thank you. That’s several years condensed down into a paragraph.

I love that. You did a great job. Many times, I get these bios that are a whole page long, so thank you for that. You started as a banker, and I can relate to that, as I was a business loan officer. You moved into real estate investing. Give me a little bit more clarity. As a business loan officer, I never did business loans for real estate. Talk to me a little bit about how that transition happened for you.

I didn’t get into banking because I wanted to be a banker. I got into banking for two reasons. 1) My wife worked for a bank and didn’t like working at the bank and thought I would fit in. 2) I hated my current job. If you hate your job, you’re open to other opportunities. If your wife says, “This might be a good job for you,” you listen to her. That’s how I backdoored my way into banking.

I thought, “I want to own and operate my own business one day.” I would think being a banker is probably a good position to be in. It will introduce you to all these small business owners and get to talk to them and know them as friends. They’ll tell you the good, the bad, and the ugly, and they did. That’s why I stayed a banker. It looked like it was going to be extremely difficult to do what they did, and they were always frustrated with making payroll and having multiple employees and government regulations. I thought, “I’ll stay being a banker.”

That was fine until I hit the age of 45. At that time, I was still married to the same wife, but she wasn’t working at the time. We had four sons at home. I was making about $80,000 a year when I was 45 back in 2007. I always looked at it as a football analogy. Everybody knows about halftime. Halftime is half the game is over, and people make halftime adjustments. Are you ahead? Are you behind? What are you going to do for the next half? Twenty years into your career, when you start at 25, you get to 45, and you’re going to retire hopefully at 65. You want to take a look at where you are or what your score is.

Review your life once you get to the halftime of your career. If you started working at 20 years old, look at where you at when you reach 45 and make halftime adjustments. Share on XI pulled up all my numbers as a banker, filled everything out, and realized, “I’m behind. In fact, I’m so far behind. If I don’t do something different, then I’m going to have to live in a van down by the river like Chris Farley did on Saturday Night Live and eat government-subsidized cheese.” I wasn’t going to be that bad because I was saving. I saved every year from the very first job I had at age 22. I started my 401(k).

I never stopped saving, but the pile of money accumulated over the years was nowhere near enough to generate anything close to maintaining my standard of living, so I knew I had to make a change. That’s what motivated me more than anything else to find something that would fill the gap. When I looked at my loan portfolio, the only people I would trade places with were the people to that I had lent money in the past that were real estate investors.

That’s how you got turned onto real estate.

I avoided real estate for so long because my problem is I don’t have two thumbs as far as being able to do any work whatsoever. If you gave me a hammer, I might not even know what end to use. Assuming I figure out which to end to use, the end result is going to be a total disaster, and I’m not kidding. I’m terrible at anything about fixing. In fact, I joke with my wife my favorite tool in the tool belt is the checkbook because I’d rather pay somebody to do it than do it myself.

I am so with you. My husband is fairly handy. A lot of the little stuff he’ll do, but I am all about the pen and checkbook. That’s my favorite tool. My favorite tool is the pen. I write a note, and I write a check.

Pay the professionals. They do it once, and then you get to enjoy whatever you want to do with your time.

Talk to me about what happened next. What are the results? You started with zero.

I started less than zero because typically, one of the biggest holdbacks for people into real estate is, “I don’t have the money to buy a house. I need to have 20% or 25% down. I’m afraid of debt, so I want to have 100% down,” so they look at their checking accounts, “A house costs $100,000. I don’t have $100,000,” close the checkbook and done, but I was a banker. I said to myself, “I don’t have $100,000,” and that was my goal. I wanted to buy a house and fix it up for $100,000. Remember, this is 2007, so this is several years ago.

In which market?

It’s Nashville, Tennessee. I looked at my checkbook, and I didn’t have $100,000, but I did have a W-2 job as a banker, so I made $80,000 a year. I had clean credit. I had a good credit score and my secret weapon. I knew the easiest bankers in the city. I know which ones had the lending authority of $100,000 for newbies that liked me that would trust that I would pay it back.

I called this individual and said, “I’d like to borrow $100,000 unsecured.” He said, “What are you using the money for?” I said, “I’m going to buy a house, fix it up, and put a renter in there or sell it.” He said, “You’re working at another bank now, right?” I said, “Yes.” “How much do you make?” I told him, and he said, “Check box one. You got a job with an income. Check box two, I got good credit,” and then number three, “If you don’t sell the house, I’m going to have to take it as collateral and put a mortgage on it.” I said, “No problem.” He said, “Come on up, I’ll give you $100,000.”

That was how I got into real estate. I borrowed the entire amount from another banker. I had that in my back pocket because I wanted that first. The next thing I had to do was find somebody who would show me how to do this. Step one was to have the money or know where you’re going to get the money. Step two was who’s going to show you how to do something you’ve never done before.

I started thinking about people I’d let money to from other banks because I’d been through, at this point in my career, seven bank mergers that had been bought out. I’d leave at a bank, go to another bank, and start fresh with another bank. Some banks like real estate loans, and some don’t. I would lose track of some of these folks, but I remember them. I helped a lot of them get started.

I called this one individual and said, “Let’s go to lunch. I want to ask you a question.” When I took him to lunch, I said, “Can you teach me how to flip a house?” He looked at me and said, “No,” and I was like, “What?” I would’ve bet money because I helped this guy get started. He goes, “No. I get up at 3:00 AM, and I’m in my pajamas. I can’t show people to do this, but you don’t need me. You need these people because these people have a formal class, and they used to be one of your customers too, Dave, so wake up and smell the coffee.”

I’m like, “Lunch number two,” I went to lunch number two, and they said, “Yes. We will teach you how to flip a house.” What we do is we have a class in a house. It was a husband and wife. “We’ve been doing this for several years. We have 144 houses. We have a full-time property manager on staff and a full-time repair and maintenance guy on staff. You come into our house. We’ll take six Saturdays and go through all the lessons, and then your final exam is to do your project house, which we’ll help you with, but you’re responsible for coming up with all the money because that’s what real estate’s about.”

I said, “Sign me up.” I went to the house for six classes in a row. I had the money lined up. We fixed the house up before we even finished it. Somebody said, “I’d like to rent this house.” Quick story, that person moved in and has been the same tenant ever since in that house for several years and not one turn. After we finished, I said to them, “Time out. I’ve done everything you said. The whole time I was doing it, I was biting my tongue because I either wouldn’t, couldn’t, or didn’t want to do 95% of what you were teaching me, but I did it. I didn’t complain.” They said, “Why in the world would you do this? Why would you spend this money and all this time if you’re not going to do what we taught you?”

I said, “I needed to know what value I brought to the chain because if I can’t bring value, I can’t be a part of real estate investing.” What they said was, “How do you want to work this?” I said, “Here’s what I propose. I don’t want to ever flip another house. I never want to find another house. I don’t want to manage the house.” “What do you want to do?” I said, “No, I will bring you unlimited amounts of capital, so you don’t have to put any money in the house. You just do all the work because you guys are pros. You’ve got a system already. I want to plug it into your system. What I bring is unlimited capital.”

They looked at me and said, “We see you’re driving a Toyota Corolla, Dave. You’re not rich.” I said, “You’re right. I’m not. I borrowed $100,000 for this first house. However, I know people who are doctors, dentists, and business owners who have plenty of money but no time or desire to learn how to do what you do. They don’t even have the time to take the class with you that I took. If I bring these people in, you do the work, and I get a piece of each property, we can build a very successful team. We can do way more houses as a team than we can do individually.” That’s what we’ve been doing for all these years.

That is an awesome story.

It wasn’t something I planned from the beginning, but I had to figure out that if I didn’t bring value to this equation, I couldn’t do real estate. I knew I didn’t want to do the hard parts, which I couldn’t do, but I did know there were people out there that were very good at it. If I could take something off their plate that they didn’t want to do, like talk to bankers or investors and gather their money which was a walk in the park for me, then I could say, “As long as you can perform and get base hits on every house that we don’t lose money, I can find you unlimited amounts of money.”

Have they?

They have. Now, with all the partnerships I’ve been involved with doing the same thing for several years, we have 119 properties.

This same team is the one that does the actual legwork for it. Is that true?

They were my original team. They’re still partners with me on the majority of my houses in Nashville, but as you probably have heard in the news, Nashville is a hot real estate market. The numbers stopped working for new purchases. My first purchase in Nashville was $70,000 for a 3-bedroom, 2-bath house, 1,400 square feet. That house is now worth $325,000. It doesn’t work in Nashville, so I had to find another group of people to do the same thing in another city.

I moved 42 miles Northwest of Nashville to Clarksville, Tennessee, which is home to the 101st Airborne Army Post. I did it with an investor lady up there who was extremely good at it. I did the exact same pitch to them. I did it with another group that I found in Memphis, Tennessee. I then branched into Little Rock, Arkansas. Essentially, I can find teams in different cities that are good at what they do, and then I bring the capital as I did in Nashville originally. These are cashflowing markets.

How are you picking the markets?

Basically, the numbers have to work. One of the things I feel strongly about is that I have two mandates with what I’m doing. It has to be profitable, or I won’t continue. That’s a given, but there are two major prices that are brewing that will never be fixed in our lifetime. The first one is the retirement income crisis. The issue with the retirement income crisis is people like myself, when I looked at my 401(k) statement at age 45, are not able to save enough money through a middle-class job to replace their current standard of living.

I’m not talking about having their lifestyles rich and famous and lighting cigars with $100 bills on their yacht. I’m talking about I want to maintain the same living standards that I have now. I read a report that over 50% of Americans are retiring are around $40,000 a year in income, and most of that is from social security. They’re having to scrape and cut expenses.

W-2 Job: 50% of retiring Americans only have around $40,000 annually, most of which comes from social security.

The second thing that we all probably are familiar with is there’s an affordable housing crisis. Builders cannot build anything that even approaches “affordable” housing for most individuals. When I say affordable, there is no such thing as affordable housing if you don’t have an income. You have to have a base of income, and that’s why I named my book Middle Class to Millionaire, but even the middle class is feeling squeezed in housing now.

What we tend to focus on is finding 20 or 30-year-old houses that you wouldn’t want to move into because they’re not that good-looking, but putting the money in them to fix them so that they are livable and rentable, but because we’re buying an older house and fixing it up, we’re not tied to new construction costs. We are now trying to build a brand-new starter home in Nashville with a lot already paid for because we owned it. It’s probably going to cost $225,000 for a starter home, and if you add the lot, that’s $325,000. That’s the bare bones and nothing fancy starter home. That’s where we are in this country for a lot of the people.

You’re picking markets where you can go in and the numbers have to make sense. You can get older homes that you feel you can fix up and still make a profit. What kind of returns are you looking for cashflow-wise?

Cashflow-wise, it’s roughly $200 to $250 per month after all expenses. That’s why I say this, these aren’t home runs, and you’re not going to retire in one. When I originally got started, I thought to myself, “This was my plan before I had the plan that I have now.” Let’s say I can hold my nose, stumble through this, and have ten houses. I’m going to get one house a year for ten years. I’m going to put a twenty-year loan on the first house. When I turn 65, that house is going to be paid for every year after that.

If all my houses are paid for, and I am bringing in $1,000 after all expenses, taxes, insurance, repairs, and maintenance. That’s $120,000 in retirement income. That was my original goal when I decided I hated this as much as I thought I would. I need to find mentors. The original deal I had with my mentors, who did all the work, was I was going to get 25% of each house. That meant for me to do the same amount of houses, I had to do four for every one, but instead of me doing the whole house hating it, having blood, sweat, and tears, mostly tears in every single house, they would call me and say, “Dave, we found a house. We need $80,000 to buy it. We need $20,000 to fix it up. Go get the money.”

W-2 Job: Look for mentors before jumping into real estate. This will make it easier for you to build passive income, with mentors doing all the work and you getting 25% of each house.

I then would make a few phone calls and a few emails, and minutes later, I’d have the money. I was done. I was like, “I’m going to get paid on this house for as long as we own it, and I’m going to get my portion of the cashflow for years, and it only took me fifteen minutes.” That’s why I decided I could keep my day job. I don’t have to quit it. All these things started happening, and I saw the money coming in and thought to myself, “This is cool.” Everybody needs to hear about this.

You took my breath away. That was amazing. There were two things you needed to do. You need to find the money and a mentor. Those were the first two things that I also did. Initially, my mentor was my dad, but I had that in the can. I had to find the money. Those were my first two things. I knew I needed those. What were the other obstacles that you faced getting started?

A big one I’ve alluded to multiple times is how inept I was. I always thought you had to be able to do everything. It was good to do a whole house once by myself because I knew for a fact I didn’t want to do property management. I don’t want to fix the house up. I would have to work with contractors anyway, and they would know I don’t know what I’m talking about. They would probably rip me off six ways.

In the back of my head, I thought, “Surely, I can find these houses.” This was in 2007. There were foreclosures everywhere. I was shocked and dumbfounded at how difficult it was to find a house. In fact, I had to cheat after a while because I would go out on my lunch hour or one-hour break from the bank, and I would be driving for dollars looking for houses. These were houses that had clearly been marked as foreclosures.

It wasn’t like I had to uncover any secrets or anything. I’d write down the name of the sign, call the real estate agent, and say, “I drove by this house, and I want to buy it.” They would ask me a few questions, and eventually, they’d figure out I was an investor. They knew it wasn’t retail. That turned a lot of them off. A couple of them would say, “I’ve already sold that house to a buddy of mine who’s an investor, so you can’t have that one.” I’m like, “Why do you still have your sign-up?” He said, “Looking for people like you to add to my database,” and I’m like, “That’s wasting my time.”

A few times, I’d get a real estate agent, and they would say, “That house you’re trying to buy in the market it’s in is worth $100,000, but it needs about $20,000 worth of work, so we’ll sell it to you for $80,000.” While doing my six classes, I knew that I should be able to buy that house for $60,000 and then put $20,000 in it, and then I could sell it for $100,000 if I wanted to flip it. The agent told me, “You can’t do that.” I’m like, “Yes, we can,” and then I got hung up on.

I was like, “This is hard. I can’t even find a house.” You got to kiss a lot of frogs to find one that works. Finally, the light bulb came into my dense little head, and I said, “I’m going to call my mentor,” and I said, “Winter’s coming, and I want a house. I’ve got the money lined up. This is frustrating. You’ve been doing this for several years, I bet every day your phone rings, and someone’s offering you a house because they know you’re a known commodity that can put cash on the barrel head. Would you please do me a favor and help me get the first one? By the way, take me to other students that were doing the same thing I was.”

The first one was tearing wiring out of the drywall. My eyes were big because I couldn’t even find the wire in the drywall to pull it out. The second house that went to someone was on the roof with a sledgehammer and was taking down a demoing of the chimney. I looked at them, thinking to myself, “There’s no way I wanted to be this heavy of a lift of my first one.” I was happy to break even to say I did one. I told them, “I’ve got a scale from 1 to 10 on how hard a house is, and my scale is the low-end under one. It would be a vacuum cleaner and a paintbrush. On a ten, they would be a sledgehammer and a bulldozer.”

On my first house, “Please find me a two.” That’s the highest I want to go. I told them, “We can break even on it, but I don’t want to do a heavy lift.” The next day she called me and said, “Dave, we found your house. That’s a two,” and it was. I’m like, “I’m terrible at finding a house, fixing them up, and managing them.” That pretty much left me with the money guy.

There are some things I want to highlight there that are valuable. There’s a thing that I do that drives my husband crazy, and that is that I’m constantly asking. It’s not that I’m asking questions like how this work and how that work. I’m asking for an exception. What that looks like is we’ll go to a café, stand in a long line, order our lunch and our coffee, but we forget something. We go, and we sit down. Usually, that something is something simple. We forgot our waters. The way that the café might work is that you have to stand in line again because it has to get in line. They’ve got their systems, and you don’t want to interfere with the systems. I understand systems, and I want to be respectful.

However, if there’s a 20-minute line and I’ve got a 30-minute lunch, and we’ve already waited in line, I don’t want to do that. I’ll go to the back or the side and say, “I’m very sorry. I did not ask for our water while we were in line. Would you consider giving me some water?” Invariably, the answer is yes. If you’re at Starbucks, they’ll always be like, “You should stand in line, but we’ll do it for you.” You get a little gruff, but I’m not afraid to ask. There are times when it’s not for a cup of water but for other things. They’ll say, “You need to stay on the line like everybody else.” They’ll say no. That philosophy of asking in spite of the fact that you might get a no is a superpower.

David demonstrated this perfectly. These teachers have lots of students. They’re teaching a particular system, and he was like, “No, that’s not going to work for me. Let me ask some questions. Could you do this?” Not only, “Could you do this,” but, “Could you do it this way?” He went so much deeper. What happens is so many of us are even afraid to ask.

I’ll have tenants come through my houses, and they’ll say, “I don’t have good credit. If I apply, are you going to say yes?” What I’ll say to them is, “I can’t say yes unless you apply.” Nobody can say yes to you unless you ask the question. You’d be surprised how many people will if you do. What I love is how David is, “No, this is not going to work. This is what will work. I’ve got mentors. Let me ask the question.” Many of us are too shy to do that.

To give another example in daily life, the other day, we stood in line, and I forgot to order a coffee. These people at this café know me a lot. This is the other thing. They know me and know that I will ask. They still love me. You’re afraid if I ask the questions, they’re not going to like me anymore. They think I’m imposing, it feels bad, they’re going to judge me, or whatever. They love me there. I go up, and I’m like, “I don’t want to stand in line again. I forgot my husband’s coffee. Would you mind giving it to me now, and he’ll pay later?” “Of course.” It’s just asking questions.

These are menial things that I’m talking about in my daily life. David did that on a bigger scale with his mentors and with his real estate. I want you to see and start practicing this. Start practicing asking for what you want. Do it kindly, gently, and respectfully. In everything you do, start building that asking for what I need muscle. Get it to a point like you are with David where he needs to make this business work. He knew he was behind, but he wasn’t afraid to ask questions.

You can build the asking-the-question muscle in your life to then when you find a mentor and find a situation where you need to ask a question, then you are willing to ask it. I’ve been asking financing questions like crazy now because I’m trying to hold onto a piece of property that I would rather not sell. I’m getting no all over the place. I’m still asking because I’m not afraid to ask. There’s a way to do this, and if there’s not, it’s not going to be a nightmare. I’ll sell the property. I would rather not, but I keep asking questions.

Even though my loan, the situation, and the property are difficult, I never get a, “I won’t look into this.” I get a, “Sure, Moneeka. Let’s take a look,” because I ask respectfully, and people like working with me. There are times that they benefit from my ask in this particular case. Your team and mentors have benefited from your ask. The cafe benefits from my ask because I keep coming back and bringing everybody with me. They get a ton of business out of me. Let them benefit from your ask, but don’t be afraid to ask. David, your story is so perfect for that lesson. I hope it’s okay that I took the time to share that. Do you agree with me?

Yes, definitely. That’s what holds a lot of people back because they’re so timid and thinking that was an option, they would’ve told me. Believe me, everyone’s busy doing what they’re doing, and they’re so focused on what they’re doing. They don’t have time to stop and consider that there’s another way sometimes. I have 4 sons, and 3 of them would take whatever I said as, “That’s what dad said. I’m not going to move,” but my third son would always negotiate. The other boys would look at him, “That’s not fair,” and I’m like, “Sure, it’s fair. You have the same opportunity as he did. He just took it.”

People are sometimes so busy doing their work that they don't even have time to stop and consider a better way to do things. Share on XIt’s true for me and my sisters too. I will ask, and the youngest one will go with whatever they are told, like you said. If there were a different option, they would tell me the other option. The problem is there are 100 options. They’re not going to go through all of those. You think of the option you’re interested in and ask if it’s available.

Essentially, if he threw an option that I didn’t like, I would say no to that too, but occasionally he would come up with something that I was like, “I didn’t think about that. Let me think about that.” He would get something that he was wanting. Anybody can do this, but having it done to you versus you being the person asking is a different strategy.

I love that. Talk to me about investing in 2022. Can we still do this and still make passive income?

Yes, you can, but you always have to keep your eye on the numbers. There was a recent article in your Apple Newsfeed that said there are four markets in the country that still have affordable housing based on the population. That’s Detroit, Michigan, Memphis, Tennessee, Tulsa, Oklahoma, and Oklahoma City, Oklahoma.

There are always markets that have affordable housing based on the numbers like, “This is the average person’s income. This is the average rent.” Do the math and see if it’s affordable. You have to reverse engineer and say, “Can I make this work by buying a house for X, adding this to the renovations? This is my maximum number,” and run the numbers on the debt and say, “It cashflows $200 a month.” I can do stuff all day long until those numbers change. When the numbers change, which they do eventually, then you find another market that’s affordable.

W-2 Job: There will always be markets with affordable housing based on the numbers.

Don’t get married to a market. That’s another thing too.

Yes. I started in Nashville, and the numbers do not work in Nashville at all.

You started in Nashville because you live in Nashville. Is that true?

Also, because the numbers worked. If the numbers didn’t work, I’d give up. Luckily, sometimes I didn’t even know the questions to ask until I had the experience to know what to ask. When I first started, even though we bought our first house for $70,000, that was a house that literally nobody wanted. That makes you nervous, saying, “Other experienced people don’t want this house. Should I be buying it as a rookie?” but the numbers worked.

When the numbers work, you have to say, “If there’s a renter out there that will pay what the market rent is and I can run this at this cost, and if the numbers work when I put a loan on it where I’m going to make $200 a month.” You’re not going to retire with that, but that first house will get you started on the path to retirement.

What is it that you know now that you wish you had known when you started?

The mindset issues keep people from doing things that they want to try. The fear of failure, the fear that this won’t work for me, and the fear of being scammed, everybody has those same fears. No matter who you talk to, relatives or friends, “I’m thinking about doing X,” there’s always somebody that can pull a bad story out and say, “Don’t do that because I knew a person and they did it once, and they’re living in a van down by the river now.”

Having been through banking and doing commercial loans, I’ve seen people in every type of business succeed, but I’ve also seen people try to do the same type of business and fail. Typically, it’s not the system. It’s whether you are cut out to work in that system. I was a small business administration loan officer, so I’d get every single person that hated their job that woke up on Monday and say, “I’m going to go see the bank and tell them about my dream, and I want them to give me a loan for it.” I would try to talk people out of it and say, “Your business is a half-baked idea.”

A lot of people would say, “I want to start a restaurant,” and my first question was, “Have you ever worked in a restaurant? You are literally cooking and cleaning all day long. It’s hard work. I would rather go try it before I bought it and put my house on a mortgage to make sure it was something I wanted to do.” These mindset issues are real to us individually, but if things are done correctly and if people have been there before you can show that instead of going down that path which has a cliff that you got to climb, walk over here, and there are steps, it makes a huge difference.

I love that. I’m all about the mindset piece. That’s right up my alley too. The biggest asset that we have is real estate between our ears. If we grow that into a good valuable asset that supports our life, everything else is so much easier.

I told you at the beginning that I avoided real estate because of all the things I knew I couldn’t do or wouldn’t do. I kept coming back to the one thing that motivated me more than anything else, which is this is working for people. Housing is such a basic need. Everybody is spending money on housing. It’s not like you’ve got to introduce this new concept of, “Come out of the woods. Let’s live in this nice heated box.” That’s nothing you have to do to convince people they need a house. You have to provide affordable, comfortable, and safe housing. If you do that, there are plenty of people that will pay for you to live there.

This conversation has been amazing. Thank you, David.

Thanks for having me.

I want to let you ladies know we do have more coming up for EXTRA. David’s going to share with us the four Fs for success in real estate. He’s got a little system he wants to share with us, so stay tuned for that. David, can you tell everybody how they can reach you? Also, you’ve got a special gift for everyone.

There are two basic ways to reach me, and it’s not through Instagram because I take no pictures, and it’s not through Facebook because I only post once a year. My obligatory, “Here’s my family and what they look like at the beach,” that’s the only post I do with those two. One that I am active in and one that I’m targeting the book towards are W-2 employees and self-employed people, and most of those people professionally would be on the LinkedIn website.

If they can connect with me through LinkedIn, my name is David Vernich. I’m in Nashville, Tennessee. As far as I know, I’m the only David Vernich in America. It should not be that hard to find. The second way is I do have a website called MoneyScoreboard.com. It doesn’t make sense unless you read the book, but there is a little money scoreboard that can be filled out to show you how far away you are from being able to retire.

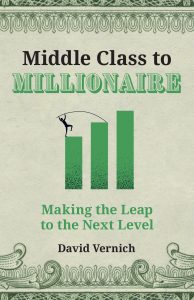

Tell us about the book.

The name of the book is Middle Class to Millionaire: Making the Leap to the Next Level. It is trying to get the knowledge I’ve obtained for several years into the general public. For anybody that likes Seinfeld, I call it the Festivus for the Rest of Us because most real estate shows tend to focus on, “Do it all yourself A to Z. Be the superwoman or superman. Go find them. Go lift bales of hay. Go chop trees down. Draw all this stuff,” and then the rest of us who are W-2 employees are like, “I don’t want to do that in my free time.” There’s way more of us than there are of them out there, the superstars.

The normal middle-class people, if we can band together and do things like teamwork and each take a small piece of the deal but essentially band together, then not only do we minimize our downside risk, but we greatly increase the probability of success. That’s what I’m trying to get across in the book. Real estate investing can be, when added to your retirement account, something that will supercharge the amount of money that you’ll be able to receive, not only in retirement but way before retirement. I don’t want to wait until I’m old and crippled to start pulling money from my retirement. I want to enjoy life now when I’m still young. This is a way to do it.

The book is called Middle Class to Millionaire. David has very generously offered for my community to give you a digital copy for free so you can get to know the way that he works and has done this. If you want to do that, go to BlissfulInvestor.com/MiddleClass. You may be middle class now, but you can become a millionaire too. David, you shared with me one of your goals. Could you share that with my audience, so they know where you’re coming from?

I never looked to be a best-selling author. I just wanted to get this information out there, but I was pushed by several groups and friends to come up with a hard and fast goal on what I wanted to accomplish by releasing this information. I feel like I can help a lot of people to fill the hole of the retirement income because that’s a big crisis coming down the pipe for people that are getting up in age like myself as well as an affordable housing crisis. This fixes two major problems for a lot of people.

However, I’m only one person. I don’t have a big staff of people. In order for me to help as many people as I can, I’ve got to limit what I can do. I feel like I can help 100 individual investors obtain at least ten houses, and we do that in a partnership program. I’m holding their hand along the way. They have to qualify and bring value to the process, but I help them see the value they bring. Frankly, some people won’t have the necessary ingredients to do it, but most people would be surprised that they’re already ready to make this next step.

David is looking for partners that he can help to build their wealth together. I love that. Thank you so much for sharing that, David.

I’m glad to help.

Are you ready for our three rapid-fire questions?

Hit me. Let’s go.

Give us one super tip on getting started investing in real estate.

They’re already doing it by reading this episode. To me, there are a lot of shows out there that can teach you, and you’ve got a great one, Moneeka. Talking to somebody like yourself is a free and easy way to do it on your schedule and time and to hear real-life stories, not fake stories, not scams, but real-life people doing it every day. That, to me, gives you the belief system that this can be something that you, too, can do, which will take you to the next level.

I love that. Thank you. What is one strategy for being successful as a real estate investor?

You alluded to it earlier, and that is asking questions. A lot of people keep everything to themselves. They might read or hear something but then don’t say anything. You’d be amazed if your radar is on. In any social engagement whatsoever, how often can you probably insert something having to do with finances, retirement, or real estate investing? You got to be listening for the clues. When I’m in a group setting, and somebody has not said something that triggered, I can talk to them about real estate.

If you turn your radar on or get into social engagements, you'll be amazed at what you can do with your finances, retirement, and real estate investing. Share on XA lot of what you’re saying is asking it in your own mind. When you’re listening, that’s how you know if you’re asking those questions.

Plus, a lot of people in the back of their minds are trying to figure it out too. If you can be somebody that can provide one piece of the puzzle that they were looking for by offering something that you learn from a podcast or a book, that opens the door to some great conversations and maybe even some partnerships.

What is one thing that you do every day that contributes to success?

I eat my own cooking. My goal is as I continue to grow my portfolio of real estate, I’m always looking for my next purchase. For example, I try to do one thing every day that moves the needle in real estate. My last partner and I have known since I was nine years old. We’re 50/50 partners, and as 50/50 partners, we bought two houses on the same street in Little Rock, Arkansas. We used cash to buy them, which was our own cash, but we didn’t want to keep it tied up there.

We had to go to another bank and finally had the loan closing to pull out 80% of the cash we had invested in those houses. Here we are at the restaurant, and we have a check for $134,172.40, which was the refinance from one, and a check for $115,229.40. I said to him, “Would you have ever believed when you first met me, when we were nine years old, that we’d be sitting at a restaurant at this age swapping six-figure checks?” He said, “No.” He then got his brand-new convertible Corvette car and drove off. He looks way more successful than I am because I drove away with my Toyota CHR with 200,000 miles on it. However, I was so happy for him because a lot of the money he made was because of our partnership.

I love that. Success looks different to everybody.

He asked me if I wanted to get in the driver’s seat, and I said, “I don’t think I could get back out. It’s so low to the ground, so thanks.”

That doesn’t look like success to you.

Trying to crawl out of a car in the parking lot would be very embarrassing. I’m like, “I know how far my knees could go. I’m good. I’ll stand and look at you. I’ll admire your car from a standing position.”

That’s a funny story. David, this has been a great show. Thank you for all you’ve shared.

My pleasure. I do appreciate you having me on here. I hope this helps your audience knock out some of those limiting beliefs that they might have in their mind that they can’t do this because I know they can.

I know they can, too, and your book will help. Ladies, remember to go to BlissfulInvestor.com/MiddleClass and get that book. We’ve got more in EXTRA. We’re going to be talking about the four Fs for success in real estate, according to David Vernich, so stay tuned for that if you’re already a subscriber. If you’re not, please go to RealEstateInvestingForWomenEXTRA.com, and you can subscribe there. If you’re leaving, David and I now, thank you so much for joining us. I look forward to seeing you next time. Until then, remember, goals without action are dreams. Get out there, take action, and create the life your heart deeply desires. I’ll see you next episode.

Important Links

- David Vernich

- Middle Class to Millionaire

- David Vernich – LinkedIn

- BlissfulInvestor.com/MiddleClass

- RealEstateInvestingForWomenEXTRA.com

Get Dr. Shaler’s free EBook: “How to Spot a Hijackal” at https://www.forrelationshiphelp.com/help-handling-hijackals-spot-signup/

To listen to the EXTRA portion of this show go to RealEstateInvestingForWomenExtra.com

——————————————————

Learn how to create a consistent income stream by only working 5 hours a month the Blissful Investor Way.

Grab my FREE guide at http://www.BlissfulInvestor.com

Moneeka Sawyer is often described as one of the most blissful people you will ever meet. She has been investing in Real Estate for over 20 years, so has been through all the different cycles of the market. Still, she has turned $10,000 into over $5,000,000, working only 5-10 hours per MONTH with very little stress.

While building her multi-million dollar business, she has traveled to over 55 countries, dances every single day, supports causes that are important to her, and spends lots of time with her husband of over 20 years.

She is the international best-selling author of the multiple award-winning books “Choose Bliss: The Power and Practice of Joy and Contentment” and “Real Estate Investing for Women: Expert Conversations to Increase Wealth and Happiness the Blissful Way.”

Moneeka has been featured on stages including Carnegie Hall and Nasdaq, radio, podcasts such as Achieve Your Goals with Hal Elrod, and TV stations including ABC, CBS, FOX, and the CW, impacting over 150 million people.

Syndication Series #5: Scaling A Multifamily Portfolio With Liz Faircloth

Multifamily is the ultimate goal of many real estate investors in America. Achieving the dream is possible, but how about scaling? That’s where Moneeka will help as she discusses scaling multifamily investments with the cofounder of the DeRosa Group and the Real Estate InvestHER community, Liz Faircloth. Liz talks about getting into real estate, how she and her husband pivoted into multifamily, and what you need to know about out of state investing. Learn more from Liz and Moneeka about the multifamily market by tuning in.

—

Watch the episode here

Listen to the podcast here

Syndication Series #5: Scaling A Multifamily Portfolio With Liz Faircloth

Real Estate Investing for Women

In this episode, I am so excited to welcome to the show, Liz Faircloth. She Cofounded the DeRosa Group in 2005 with her husband, Matt. The DeRosa Group, based in Trenton, New Jersey, is an owner of commercial and residential property with a mission to transform lives through real estate. DeRosa has vast experience in bringing properties to their highest and best value, which includes repositioning single-family homes, multifamily, apartment buildings, mixed-use, retail and office space.

The company controls close to 1,000 units of residential and commercial assets throughout the East Coast. Liz is the Cofounder of The Real Estate InvestHER community, a platform to empower women to live a financially free and balanced life through over 25 Meetups across the US and Canada, an online community and membership that offers accountability and mentorship for women to take their businesses to the next level.

She is the co-host of The Real Estate InvestHER Show, which I will be on too. They published their first book, The Only Woman in the Room: Knowledge and Inspiration From 20 Women Real Estate Investors. Liz has been interviewed for many articles and top-rated podcasts, including mine, including being a two-time guest on the top-rated BiggerPockets Podcast and the Best Ever Show. On the personal side, Liz is an avid runner, has completed several triathlons and marathons, has two adorable children and is a New York Mets fan. Liz, welcome to the show.

Thank you so much for having me.

It’s nice to see you again. You and Andresa do so much cool stuff with the investor community. I love what you’re doing together, but I haven’t gotten to chat with you about what you’re doing. Why don’t you give us a high-level version of your story of how you got interested in real estate and what your path has been?

It wasn’t a linear path. My husband and I at the time had started dating. Before we started dating, I was in graduate school for Social Work. I got my Master’s in Social Work, wanted to open my practice and help people. That’s always been my passion. I grew up in a great family but middle-class family. My dad was a school teacher. I was never introduced to entrepreneurs or investors. That wasn’t in my sphere of any context growing up. Hard work ethic was there, but certainly the business piece of it, I was not familiar with or didn’t have a lot of exposure.

Until I met my brother-in-law, who was an entrepreneur, started a business and handed me Rich Dad Poor Dad. I’m 23 at the time. He’s like, “You got to read this.” I liked personal growth books. I started in college reading different books and always enjoyed them. I liked learning and growing. I’m a dork in college. I’m reading Awaken the Giant Within and everyone’s like, “What are you reading?” I’m like, “I don’t like fiction.” I still don’t like fiction. I have to learn something from it.

Long story short, I read that. My eyes were open to this idea of passive income. I honestly never heard of that before like, “I can have money working for me, not me working for money.” It was a whole new opened my eye concept, which I know a lot of people have said, but what got us involved, I then started dating my now-husband. We lived about two hours from each other. Every weekend we’d go to all the REIA meetings and start learning.

Make sure you’re mitigating risk for yourselves, but most importantly, your investors.

We’re in our twenties and didn’t know anything. We didn’t have any money to invest, but we said, “Let’s just give this a go.” We start taking courses. They told you to like the door knock. This was before Facebook Marketplace. It was literally opening the newspaper, go to the foreign ads and calling tired landlords. That was the million-dollar tip we got at one of the events. That’s what we did.

Every weekend, literally, we are knocking on doors, right outside of Philadelphia, where my husband lived when I visited him. One day, we got someone to say, “That’s interesting. Let me think about that.” We called them back and struck up a deal. A year into us taking courses, door knocking, cold calling and bootstrap whatever we could do, we struck up a deal and bought our first property. It was a duplex for $150,000. We learned everything on that property. We’d go with people.

When you buy a property, the tenants that are there may not be your tenants ongoing because of a new sheriff’s in town. We learned the whole multifamily. It opened our eyes. It was only multis in this neighborhood. It wasn’t like we chose a duplex. It just happened because it was older homes right outside of Philadelphia. There were only duplexes and small multis. Long story short, we got our start there, we moved to New Jersey and started our business. We focused on New Jersey in buying properties there.

We sold that property and did a 1031 into a four-unit and then that started our trajectory in New Jersey. Over many years I’ve been doing this, we had lots of twists and turns. I wished we focused on multi, but we didn’t. We got involved in a lot of different things early on, like people who get distracted as they do and people that are probably a little naive, little young as well, can do. We flipped houses.

We got into tax liens. We bought a commercial building. We bought raw land. Every random thing you could possibly think of, we probably have done it until we doubled down on multifamily. Our business is focused on multifamily. We went from a 2-duplex to a 10-unit. We grew very steadily. We didn’t go from a 2- to a 200-unit. We did, but over time and now we focus on larger multis and we’re starting a fund where we’re investing with other operators and things of that sort.

We’re diversifying a little bit outside of multi but more from a fund perspective. I’m involved in that, not day-to-day but more from like strategic level, helping build our team out and exciting to be able to invest in different sectors of real estate, not just multifamily, but we love multifamily. We have a letter of intent on a property in the Southeast, which is where we focused on.

Tell me a little bit more about this fund. Let’s dive a little deeper into that.

The Only Woman in the Room: Knowledge and Inspiration from 20 Women Real Estate Investors

With regards to the fund, we talk to people all the time. People are like, “This sounds like a great opportunity for a passive investor.” You’re like, “I don’t have a building. I don’t have anything under contract right now.” We refer them. We know a lot of people we like and respect in the business. We have no problem with that. There’s a lot of good syndicators out there.

We wanted to have another flavor of ice cream if you will. The fund will obviously be an ongoing rolling fund and it will give investors what we’re going to invest in and all things that we know and that we’ve vetted. We’re not going to start investing in a business that we have no idea about because that’s a whole other level. It’s like mitigating risk. We want to mitigate your risks. You want to make sure you’re mitigating risk for yourselves, but most importantly, your investors.

Hard money loans will be one. We’re going to start to work with hard money operators that we like and respect, that we know to do good business. We were not the hard money lenders. They are and we’re going to do that. Multifamily will be a piece of it. If we have a project that comes up, we’re going to almost invest in our own projects. That will be a piece of it. Those are the two main pieces.

I want to say, even self-storage, there have been operators. That might be another sector. It will be all related to investing in real estate on some level, but it will be in a way that we are not the sole operators of everything. That’s where, as we evolve, it’s like, you don’t want to do everything yourself. Once you figure that out, you got to focus on that. That’s what that looks like. We’re building out a team and that’s been in the making for some time, but that’s the goal.

I’m so fascinated by that idea because I feel like for me too, there’s something that I do well. I do executive homes in Silicon Valley. I’ve got my entire system. It’s all built out. It runs itself. I don’t worry too much about it. I was telling you before that I’m taking all of May off for my birth month because that’s where my birthday is. We’re traveling to Hawaii and going to a spa in Palm Springs with my sister.

I get to have that lifestyle. It is fantastic. I’m not particularly interested in working significantly more. I do get bored because we have construction projects. We have some other stuff going on so that my entrepreneurial mind doesn’t slow down or get bored. What is happening is I’ve found several different syndicators doing different things. I’ve invested in storage, multifamily and a variety of different things like what you were talking about.

I don’t know how this is going to work for you guys, but every single time I invest, it’s a minimum of $100,000. That’s great for us because we have that money. We’re looking to retire. We’re moving that way, but not everybody who’s reading to this show has access to $100,000 for this and that. They want to be able to diversify without spending that much money. What is that fund look like for you? Is there going to be a minimum investment? Have you worked that out? What does that look like?

One organization we’ve started working with is called Republic. Basically, what they do is, in essence, have a similar type of approach in that people could invest $10,000, even down to $1,000. Don’t quote me on that but I’m not familiar. What’s fascinating though if that for our last syndication, it was a 336-unit apartment building. To your point, our minimum was $50,000 on that project. Not everyone has that, but they want to invest in real estate.

Don’t do everything yourself. Do what you do and do it well.