How To Accomplish What Matters Most To You With John Lee Dumas

2020 has been a long year. Now, we’re finally at its final chapter, and what better way to bring this challenging book to a close than to look back on the lessons we’ve learned and look forward to the next? In this episode, Moneeka Sawyer invites John Lee Dumas, the host of Entrepreneurs on Fire, to help us bring in the new year by talking about setting and achieving the goals that matter most to us. Taking with him wisdom from successful entrepreneurs, he shares The 100-Day Goal Journal that can guide you to your success as well as what is called the SMART goal. Join Moneeka and John as they break down its components and show you how you can greet the new year living your best self and being on fire.

—

Listen to the podcast here

How To Accomplish What Matters Most To You With John Lee Dumas

Real Estate Investing For Women

I have a special episode for you. I am bringing on John Lee Dumas. He is the host of Entrepreneurs On Fire, an award-winning podcast where he interviews inspiring entrepreneurs who are truly on fire with over 2,500 episodes, one million-plus listeners a month, and seven figures of annual income. JLD is just getting started. I’ve asked John to help us bring in the new year by teaching what he lives better than most, setting and achieving the goals that matter most to us. I am excited to welcome to the show the only man on fire, John Lee Dumas. How are you?

Moneeka, it is great to be here. I love your energy and your vibe. It’s always awesome hanging out with you.

John, you put together a journal called The 100-Day Goal Journal: Accomplish What Matters to You. I know that you talk to entrepreneurs all over the place. Talk to me about why goals are important. Why did you put together this particular journal?

I’ve interviewed over 2,700 successful entrepreneurs. To be honest with you, I can only pull out a couple of themes that almost every single one of those 2,700 have in common. One of those few themes that are across the board is successful entrepreneurs know how to set goals, and then they know how to accomplish those goals that they’ve set. Frankly, unsuccessful people don’t know how to do either and they’re not doing either, and they’re suffering as a result. I wanted to create a strategy guide for people to step-by-step understand what it means to accomplish a goal that matters to them. That’s why The 100-Day Goal Journal exists, and I’m proud of that work.

I can’t wait to use it. Talk to me a little bit about what is a meaningful goal from your perspective?

“Successful entrepreneurs know how to set goals and how to accomplish those goals.” ~ JLD

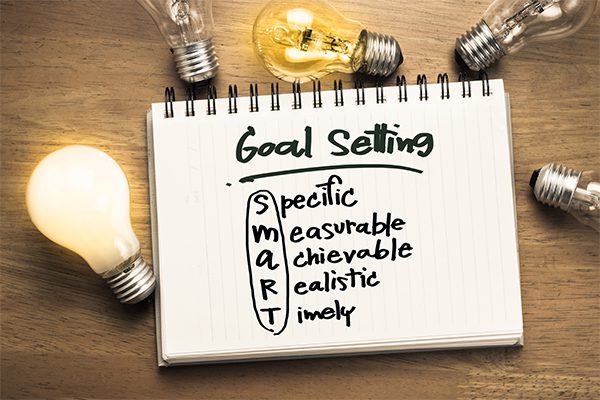

First off, you could step back and say, “Let me set a SMART goal.” A SMART goal is five components, Specific, Measurable, Attainable, Relevant, and Time-bound. It’s critical. Those five things need to be part of your goal every single time, and a lot of people don’t focus on the meaningful part of the goal. A lot of people accomplish a goal to be like, “I accomplished the goal, but why is my life still the same? It doesn’t feel like it’s moved forward.” It’s because you didn’t set a meaningful goal. You just set a goal and you accomplished it.

It has to be meaningful and it has to be something that matters to you. That’s why you’ve got to be specific with it. It’s got to be measurable. You got to measure what that goal is that you’ve accomplished. It’s going to be attainable. It can’t be unrealistic. Otherwise, you’ll quit. It’s got to be relevant. That’s that meaningful part. It’s got to matter to your life, then it’s got to be time-bound. You have to set a timeframe, which is why I use 100 days. Those are the critical components that a lot of people miss when they set goals, and it has to be a part of it.

Talk to me a little bit about the 100 days. To me, that seems like such an arbitrary number. Could you tell me a little bit about why you chose that?

I don’t want to say that it’s not arbitrary because it’s got some arbitrariness in there for sure. There’s no magical formula that 100 days is the perfect number. For me, I wanted to sit down and say, “What is a timeframe that feels realistic?” People are like, “I’m going to do this in 2021.” For me, a year is way too long of a timeframe. Yes, a year goes by like that but when you’re in the beginning part of it, it feels like you have all the time in the world to accomplish that goal because you have a full year. At the same time, anything like 25, 35, 55 goes by in a blink of the eye. I want people to not look at too short of a timeframe and say, “I’m not willing to create a stretch goal that’s going to push me.”

I want people to, number one, feel like they have a good amount of time, but not too much time that they procrastinate. To me, the 100 days slotted in there nicely where it’s enough time to accomplish something big, but not too much time where you feel like you can just slack off the beginning. You get 100 days and when you wake up the next day, you’re already down to double digits. You’re at 99 days. The clock is ticking. It’s time to get your butt moving and make things happen. It’s arbitrary, but it’s something that has worked for me, so that’s why I went with it.

Accomplish What Matters Most: A SMART goal is five components: Specific, Measurable, Attainable, Relevant, and Time-bound.

If someone doesn’t succeed in achieving their goal in 100 days, what do you recommend?

I’m a big believer that if you get to the 100 days and you haven’t accomplished your goal, it’s time to assess. In fact, in this journal, you have reassessments where you’re looking back at day 25, 50, and 75 to identify your progress and hold you accountable that you are moving forward at the pace you should be. Frankly, you’ll know well before day 100 if you’re not going to accomplish your goal because there are all these specific check-in points on the way. There’s nothing wrong at day 75 to adjust your goal down, or maybe jack it up if you’re way ahead of the game.

Nothing’s wrong with that because this is not a perfect science. This isn’t like this recipe where if you get one ingredient wrong, the whole thing’s terrible. That’s not the case. This is a fluid process. That’s the best word. Challenge yourself. If you’ve got to tweak things down a little bit by day 50 or 75, you’ll know it and do so. If you’re going to jack things up because you’re way ahead of schedule, do that too so that by day 100, you’ll know 100% where you’re going to be by that point and you’re going to feel good about it.

How do you know if you’re succeeding?

If your goal is being accomplished and you’re seeing marked progress. That’s part of the process where you are grading and judging yourself every step along the way. You’re being hard on yourself. You need to be your own worst critic. This book, journal, guide, strategy, and system ensures that you are your most harsh critic because you need to be. Nobody else cares about you. I hate to say it, but they don’t care about you because they’ve got their own stuff they care about. It’s not that they don’t like, don’t love you, and not rooting for you. Frankly, they don’t care that much about your goal because they got their own crap that they’re worried about. Their life is crazy, mayhem, and tough enough without thinking about you every 10 seconds or 10 days or 100 days. Realize that you are your own best cheerleader. At the same time, you’ve got to be your own worst critic too.

“You are succeeding if your goal is being accomplished and you’re seeing marked progress.” ~ JLD

Nobody cares about you as much as you care about you. That’s the thing. We’ve got all our own stuff. Even an accountability coach or partner is not going to care about your achievements as much as they’re going to care about their own because they’re not in your head or in your life. That’s what I love so much about this journal. It makes you your own accountability partner. Could you talk a little bit more about accountability, specifically on why is that so important?

Even though nobody’s going to care about us like ourselves, we need that kick in the butt by people who care about us. When you are in an accountability group and you have people who you’re counting on and they’re counting on you, then there comes this bond together where you are rooting for each other, checking in with each other, and don’t want to let each other down. It’s critical. I have multiple masterminds for different parts of my life.

I’ve got a health mastermind and a business mastermind because I want to make sure that I’m excelling in both areas of my life. To do that, I need accountability in both areas of my life. That’s an example of why an accountability group is important because it’s going to ensure that you don’t just slither away and go watch Netflix all day. You know you’ve got a meeting with your partners, accountability group, or mastermind, and they’re going to want to know what you’ve done.

Would you call this journal your own personal accountability partner?

Absolutely. That’s why I wanted and liked the idea of a physical journal because you can’t hide from that. You can’t put the folder on your desktop and hide it somewhere. It’s on your bed stand, on top of your desk, and on your briefcase. It’s there taunting you, “I dare you not to use me today because the proof will be in the pudding.”

“Realize that you are your own best cheerleader. At the same time, you’ve got to be your own worst critic too.” ~ JLD

I heard you on another podcast talk about focusing on your strengths when setting your goals, which many people do like, “I’m going to improve this about myself,” but they’re trying to improve the thing that they suck at. To be blissful, which is what I’m all about, you want to focus on what’s awesome about you and make it awesome. Do you agree with me on that?

We don’t need another C student in this world. That’s the problem. We will go down this rabbit hole but a big problem with traditional education is they’re like, “You got an A in this subject. Good. We don’t need to focus on that anymore. You got a D and a C here. Let’s spend all of our time here.” It’s the opposite. What are you naturally great at? What are you good at right now? How do you become even better at that? Why do you want to go from a D to a C? You’re going from crappy to still crappy. This world doesn’t need more crappiness.

What this world needs is you living in your bliss, living in your best self, and you being on fire, and that’s going to happen when you’re doing what you love and what you’re great at. That’s how you’re going to blossom and that’s what the world needs. That’s why I’m a big believer in saying, “What am I great at? Let me spend all my time doing that.” The things you’re not good at, hire people on your team to do those things or don’t do them at all because it’s not worth doing average. It’s not going to move the needle for you. I only do a handful of things in my business. I only do the things that A) I’m good at and that B) I enjoy doing. That’s it. The other things that happen in my business are because I’ve hired the right people to do those things.

If you’re good at something or you enjoy doing it, you’re still going to fail. Failure is part of the game. Could we talk a little bit about that?

Failure is 100% part of it. In fact, I was in an interview where I was talking about sports and they say, “Why do you love sports?” I’m like, “I love sports because it taught me as a child growing up that you’re going to lose and you’re going to fail, but there’s always that next game. You don’t know if you’re going to win or lose that next game, but there’s always that chance to win and hit that home run.” It’s even more applicable in business and life because you can fail 100 times in a row. If you win on the 101st time, that’s everything and that’s all that matters. That’s all people will know you for.

Does anybody know me for all the failures I had before I launched Entrepreneurs On Fire? No, because they don’t care about that. I don’t care about that. We don’t spend any time talking about that. What they know me for is my one success, which was launching Entrepreneurs On Fire. That was my first and biggest win. That’s what propelled me to where I am today. It’s even better in business than sports because if you lose 100 times and you win 101 times, your record is 1 in 101. You still won, which is great, but it’s still a crappy record. In business, you just want to know you won the game and you can take that to the highest level. That’s why failure is part of it. It’s getting back up and swinging everything.

Thank you for that. That is a big difference. In business, you can become an overnight success immediately. It could take you 30 years to get there, but then suddenly, you’re there. It’s amazing. My perspective on failing is this. When we’re reaching for a goal and we’re trying to succeed, we are becoming the person who can succeed. We become a better version of ourselves as we’re reaching for that goal. The thing about failure is along the way, it shows us who we’ve become. How we deal with those failures and how we handle a challenge or a let down shows us who we have become along the way towards our success.

In a way, it’s a milestone and a necessary thing in creating success. Without it, we don’t grow better and we don’t become bigger. The goals aren’t as amazing in general. They’re also not as gratifying. If you buzz to the top, you’re not going to be as fulfilled as if you had to learn along the way. Failure is an amazing piece of the success formula. Could you tell us one daily practice, John, that you would say contributes to your personal success?

Every day, I do fifteen minutes of yoga. It’s stretching-focused yoga. It’s part of my daily rhythm. I love it because a stretch is a time that I’m contemplating my day in a meditative state. I’m relaxed and I’m doing deep breathing. I’m having this private enjoyable moment that’s great for my body, mind, and soul. It’s this nice quiet start to my day. I will take that over a cup of coffee any day. Although I still drink my coffee.

John, this has been amazing. Thank you for joining us and sharing all your amazing wisdom with my ladies.

“What this world needs is you living in your bliss, your best self, and you being on fire.” ~ Moneeka Sawyer

It’s beenawesome, Moneeka. Thanks for having me. Take care.

—

Ladies, thank you for joining John and I for this portion of the show. Wasn’t it amazing? I am excited about starting off the year in a powerful way and helping you ladies achieve your goals. That’s what this show is all about. I’ve got more in EXTRA. I am going to be doing a process that helps you to integrate your goal into your future. What that will do is it will pull you forward almost seamlessly towards the goal that you want to work on that matters to you most. That’s what we’ve got in EXTRA. The other thing I wanted to mention is that I am going to be working on John’s journal so that I can reach my favorite goal, the one that matters most to me for the first 100 days of the year.

If you would like to join me on that, go ahead and purchase your copy of the journal. You can go to BlissfulInvestor.com/100dayjournal. Email me and I’m going to put together a list so that we can support each other towards meeting our goals. I’ll put together some videos about my process. I’ll help you, ladies, if you have questions. I have so much inspiration around this and I don’t want to let it go. I’d love you to join me through the whole process. We can do this together, but for now, stay tuned for Real Estate Investing for Women EXTRA so that I can take you through this amazing process to integrate your goals into your future.

If you are subscribed to EXTRA, stay tuned. It’s coming next. If not but you would like to be, please go to RealEstateInvestingForWomenExtra.com. You get the first seven days for free, so you can download this episode and you could download as many past episodes as you want to. You can just check it out and see if it’s for you. This might be exactly the time to get started on that extra step towards building your financial future. For those of you that are leaving us, thank you for joining me on this New Year episode of Real Estate Investing For Women. I appreciate you and I look forward to seeing you next time. Until then, remember, goals without action are just dreams. Get out there, take action, and create the life your heart deeply desires. I’ll see you next time. Bye.

Important Links

- Entrepreneurs On Fire

- The 100-Day Goal Journal: Accomplish What Matters to You

- BlissfulInvestor.com/100dayjournal

About John Lee Dumas

John Lee Dumas is the host of Entrepreneurs on Fire, an award winning podcast where he interviews inspiring Entrepreneurs who are truly ON FIRE.

John Lee Dumas is the host of Entrepreneurs on Fire, an award winning podcast where he interviews inspiring Entrepreneurs who are truly ON FIRE.

With over 2000 episodes, 1 million + listens a month, and seven-figures of annual revenue, JLD is just getting started.

Visit https://swiy.io/eof to set YOUR Entrepreneurial journey ON FIRE!

To listen to the EXTRA portion of this show go to RealEstateInvestingForWomenExtra.com

To see this program in the video:

Search on Roku for Real Estate Investing 4 Women or go to this link: https://blissfulinvestor.com/biroku

On YouTube go to Real Estate Investing for Women

——————————————————

Learn how to create a consistent income stream by only working 5 hours a month the Blissful Investor Way.

Grab my FREE guide at http://www.BlissfulInvestor.com

Moneeka Sawyer is often described as one of the most blissful people you will ever meet. She has been investing in Real Estate for over 20 years, so has been through all the different cycles of the market. Still, she has turned $10,000 into over $5,000,000, working only 5-10 hours per MONTH with very little stress.

While building her multi-million dollar business, she has traveled to over 55 countries, dances every single day, supports causes that are important to her, and spends lots of time with her husband of over 20 years.

She is the international best-selling author of the multiple award-winning books “Choose Bliss: The Power and Practice of Joy and Contentment” and “Real Estate Investing for Women: Expert Conversations to Increase Wealth and Happiness the Blissful Way.”

Moneeka has been featured on stages including Carnegie Hall and Nasdaq, radio, podcasts such as Achieve Your Goals with Hal Elrod, and TV stations including ABC, CBS, FOX, and the CW, impacting over 150 million people.

Creating Notes And Doing Good In The World With Laura Gisborne – Real Estate Women

Too often, many people make real estate investing seem harder to get into than it actually is. In fact, for Laura Gisborne, you don’t necessarily need to know everything. You can just start by buying a property, adding value to it, and watching it take you to the next. In this episode, she joins Moneeka Sawyer to help simplify the process for us. As a highly successful business expert with over 20 years of experience from structuring and selling small boutique businesses to owning a multimillion-dollar wine and real estate empire, Laura has the wisdom and insights that could help us find our path towards success. She shares some of those with us and how, more importantly, she is giving back. Tune into this conversation to learn more about creating notes and going the owner financing route, all the while doing good in the world with it.

—

Listen to the podcast here:

[fusebox_track_player url=”https://feeds.podetize.com/ep/pr3dYLub4/media” title=”Creating Notes And Doing Good In The World With Laura Gisborne – Real Estate Women” ]Creating Notes And Doing Good In The World With Laura Gisborne – Real Estate Women

Real Estate Investing For Women

I am excited to welcome you to the show laura Gisborne. She is a highly successful business expert with many years of experience. From structuring and selling small boutique businesses to owning a multimillion-dollar wine and real estate empire, she has owned nine businesses. Her first, when she was only 23 years old. She is an internationally recognized speaker and serves as a business consultant for business leaders and entrepreneurs in a wide range of industries. The innovative business model of her company, Limitless Women, exemplifies that companies can be both profitable and purposeful.

Through her initiatives, thousands of women and children are receiving regular contributions in multiple countries across five continents. She has served as a Guardian Ad Litem for foster children through CASA, Parent Education Coordinator for Family Outreach, board member for Habitat for Humanity, The New Peaks Foundation, and is on the Business Engagement Team of the Pachamama Alliance. They’re all important and relevant for what Laura stands for, that’s why I wanted to let you know what she’s about around all of this stuff. She is the author of the books, Stop The Spinning: Move From Surviving To Thriving and Limitless Women. She has been featured as a guest expert on both CBS and ABC, as well as on the national bit show, The List. Laura, welcome to the show.

Thank you, Moneeka.

Laura and I are part of a community called The Thriving Women in Business. We met at a luxury retreat with a bunch of other women in Hawaii and hit it off immediately. We have much in common. I wanted to have her on the show to share all of her wisdom with you. Laura, why don’t you start by telling us a little bit about your real estate journey? What’s your story around that?

First of all, thank you for inviting me. I’m super excited to serve you and to help however I may. Ask away whatever questions you’d like to ask. For the real estate journey, it’s interesting. I started back in 1996, I went on a timeshare tour. I don’t know if you’ve ever been on a timeshare tour or not, but it was a fascinating thing. I had no idea what it was. I said to my husband at that time, “We’re not going to buy anything. Let’s go look.” The woman who was our real estate broker, which is like you and I, we hit it off. We had a great affinity right away. The story behind the story is at that point, we had owned three restaurants in Texas.

We sold them and moved to Arizona with the idea we’re going to open up a different kind of business. A bed and breakfast or something that we could do with small hotels. Something we could do while one of us could always be with our children. This woman who sold us a timeshare said, “You should get a real estate license. You’d be great at this.” I said, “I’ve never sold anything in my life.” My background is hospitality and law.” I thought I’d be a lawyer when I grow up. God had another plan to get all these adventures, but that’s a whole other story. It took about two months at the time to get a license if you went full-time.

I got my real estate license. I thought, “This would be a good side hustle to do in the meantime. I’ll get into real estate and do that for a little while, while I’m building my next business.” I started selling, doing well in real estate. I started taking my commissions from real estate sales and buying real estate. Leverage was a beautiful thing back in the late ‘90s, early 2000s. I would buy one piece of property and then get it ramped up and then borrow against that property to buy the next one and so one thing led to another.

It’s intuitive investing. That’s what I did too. I did not become an agent, but once I started buying, I would fix it up, have it increased its value, and then take money out and buy the next one. It’s such an easy way to go. What I love about your story is that it shows women that this thing is possible in an intuitive, flowing way. There’s no magic here. You made some extra income. You decided to invest in property. That property was appreciated because you added value. You take more money out and then you bought another piece of property and just rinse and repeat. What I want ladies to read at this moment is how easy this can be because many people out there are talking about the cool ways or exciting ways to make money in real estate. You could buy everything and no money down. You can do these options and syndication. You don’t have to know all of that stuff. You can just buy a house.

That’s the piece, start with one. My first husband that I got divorced, almost two years after we’d moved to Sedona, I met my current husband. When he and I got married, he moved into my house. We turned his house into a rental. It was that piece. He said, “I can buy you a diamond. I can buy this empty lot.” I was like, “No, buy the lot. Diamonds later. Let’s get some real estate.” It’s a little hedgy. You want to start collecting and our strategy was to cashflow properties. I went to a real estate investing bootcamp in 2004 with John Burley, who was a great guy. Burley looked at what were the different strategies that were working and what works best for us over the years. I would say, it has been that cashflow that we would buy a house and then we would carry the note for somebody who was having a challenge with financing. We do owner finance for them. It worked out great. When they were ready and they were able to qualify, they were able to buy us out and it always became a great win for them too.

If you drive out of the epicenter of your city, the farther you get, the lower the prices of the houses become. Share on XLet’s dive a little deeper into that because that’s not something people have talked a lot about in this show. When we talk about cashflow, usually what people think is you buy a place, rent it out for more than what you owe on it and that’s how you make cashflow. There are lots of different ways to do cashflows. Let’s dive a little deeper into the owner financing route. We haven’t had anybody talk about that. Could you break that down for us a little?

One of the things you always have some questions about is, “What do you need to get started?” Good credit is a great asset. It’s not necessarily the only asset because even if you struggle with credit, you can bring in partners. That’s also been another strategy that was successful for us to joint venture with other investors so that we can pull our money together. We’d put in 10%, they’d put in 10%. We get our 20% down, and we would go in and do a project. That was a whole other side. Generally, we would buy a house. The strategy behind this was that we live in a high ticket area.

As real estate investors, the rule of thumb that we’ve found over the years is that if you drive out for the epicenter of your city, the farther out you get, the lower the prices of the houses become. We’ve always done well with cashflow properties from blue-collar type of families like firemen, school teachers, people that have great jobs. They may not have high revenue, but they have consistent income. They have a good job history. People fall on hard times. I talk about that in my first book. I went through my journey when I got divorced. It didn’t make my life easy with my credit. I made some mistakes, but I cleaned them up and was able to move forward.

When somebody’s gone through some life situation like death or divorce or disease, you can look at their credit and find out, “Was it an isolated time? Do they have a better history before?” Banks are not always forgiving, but as a lender yourself, you can be forgiving. You can find those people that you trust and work with them. A lot of times, that gives them the opportunity to get into a house, and our structure was, let’s say somebody who normally would pay $1,000 for rent if they were doing a lease option which is the owner finance with us who would have them pay more. Maybe they’re paying $1,300 or $1,400 a month, but a portion of that would be going towards the purchase of the property.

If they could get it together and then get their own financing, which happened for every house we ever had in Arizona, they always ended up cashing out which was great. You think as you keep them as high ticket renters for a long time, but the goal is to help others get into their own homes. You figure out a price, you buy your house for $100,000 and you decide to sell it to them for $120,000. They live there for a few years, pay the rent, and because they had an ownership in the property, they would take better care of the property first and foremost. They wouldn’t call you for every like, “I need a new light bulb,” because it’s their property. They had pride in that.

Did you get a down payment and what percentage would you normally get?

It depends on where they were. That’s the idea too. I know a lot of people that do resell houses with no money down and 4 or 5 high ticket leases. Our intention was always to have a win for them and have them be able to get to a place that they could afford.

You did take some down payment so they felt like they had bought?

Let’s say that you’re doing a security deposit on a rental. You do first, last and one-month security on a $1,200 property, that’s $3,600. Over time, they came up with $5,000. We didn’t charge them much more. The round numbers we love working-class neighborhoods as families. Those are the ones that get the hardest hit when the economy goes south.

Stop The Spinning Move: From Surviving To Thriving

With a lot of the owner financing that I’ve seen, they’re structured a little bit differently. What kinds of percentages do you normally give them towards their house, for instance?

People that are credit challenged are used to paying a little bit more interest. The interest didn’t come into the equation so much. If I could give you a base rate, it would be like interest rates you’ll see out there is 3%, if I charged 5% or I charge a little bit higher interest rate because it was a higher risk. It was more tied into the lease option.

You would charge an interest rate and everything else went towards paying down their house?

Correct.

Did you normally still have a loan on that property when you did this?

Yes.

That is such an interesting structure. I’ve never seen it like that before.

It worked well for our family and it made us feel good to be able to help people get into houses that couldn’t get in otherwise.

They’re the ones that usually get hit hard when things go bad and it’s not that they don’t want to own homes for their families, nor that they don’t work hard enough for it.

We want to be with people who inspire us, the people who lift us up, and see us when we have a hard time seeing ourselves. Share on XIt’s the idea of 10% down payments. It’s hard for them versus if they can come up with a little bit down and then pay a little bit more each month. It’s like a savings account for them to move towards where they have the equity. The house is also appreciating at the same time. It was all these years in Arizona. When they go to refinance and qualify for a more traditional loan, they’ve got some equity in their other down-payment and they would cash us out.

How quickly do they normally cash you out? How quickly do they normally buy?

It’s an average of 2 to 3 years. That’s in a market where lending was more flexible. We don’t know what’s going to happen after COVID. It’s going to be interesting to see what the banks do. Interest rates are at an all-time-record low and certain things are easier to get financing for than others.

Do you help them with getting their credit fixed if they’ve had any problems or you allow it to season its way out?

No, I think they season. If they’re motivated to buy, to purchase, they know they have to make their payments on time. I’ve met a lot of people over the years when they go all-in on hard times are good people who needed a chance to pull it together and get back on their feet.

One of the things that I love about Laura is her whole outlook on life is she wants to be a limitless woman herself. She believes in time, emotional freedom, financial freedom and true freedom. Being truly limitless and lifting the people around her. She reaches out into the world in many ways whether it’s being on boards of charities or that she finances people in their homes or the way that she coaches her business, coaching clients. Everything that Laura does, her aim is to lift those people around, to be better off than they were before.

Part of what struck me about Laura in the very beginning when I first met her is she’s always, “How can I be a service for you? What can I do at this moment to help you?” She comes from this place that I call one of my bliss tenets, which is to give back to the world, to be of service. When we’re out there and serving, it’s hard to feel bad inside. We’re being of service, but it also fills us up. It gives us more to think about, to do, to feel good about. It also helps us to raise the vibration around us because anybody who then is going to come around us are going to be people that have that same vibration, intention, and blessed in their life. Wouldn’t you say?

I would. I went to a yoga class right before you and I have this interview. I was listening to a sermon on the way. One of the things he was talking about was how much we can be around people that pull us down and how important it is for us to always surround ourselves with others who lift us up. I feel like I’m hearing it twice. God must be giving me a message. This idea of who we surround ourselves with is important. We want to be with people that inspire us, that lift us up and see us when we have a hard time seeing ourselves.

That’s kind, generous and uplifting. I know much of the time when I’m not down as often as I had been. A lot of my journey to bliss was because my life experience was very unhappy. We often focus on the things that have challenged us ourselves. I remember learning early on this thing that everybody says, you become the five people you spend the most with. It sounds trite. The truth is the most time that you spend with people, those are the people that are going to influence you the most. It’s important that you decide who you want those people to be and you do have control over that.

Creating Notes: Banks are not always so forgiving, but as a lender yourself, you can be and you can actually find those people that you really trust and work with them.

We don’t have control over the family and don’t dump your family. You don’t want to do that. You want to make sure that when you’re out there in the world, when you have the choice, you’re choosing people who are going to support the joy in life, help to uplift you and support your values. I can’t imagine Laura ever hanging out with someone that did not believe in philanthropy.

It’s not a new journey for me. The work that I do is all about business training, to lift women so that they can use their profits for purpose. All of that’s come as a typical overnight sensation. I started volunteering many years ago. While I was building my private sector life, our restaurants, our retail stores, our real estate and our wine business, I was always volunteering as a separate. I felt like I had one foot in either world. I had a private-sector world and my volunteer world. What’s been beautiful is over these last few years, we put our stake in the sand and made our whole business about fundraising and raising awareness.

Even prior to that, even when we were percolating this business starting about 2012, that was always a common theme. We’re good. We’ve raised our children. We’ve traveled the world. My husband had a terminal diagnosis many years ago and now he is healthy and on track. We’re thrilled. We try to celebrate every day that we get to have together. For us, the motivation is not about how do I make more money. I’m more curious about how I can use my experience and my voice to lift up other women that they can find sufficiency and freedom for their families, and then join us in the contribution phase. What we know from experience of doing this work now is it’s difficult for women to see themselves as philanthropists and givers when they’re struggling financially. We need to help them get to sufficiency first.

You and I both started at a place where we weren’t in a financial place that people would normally think of us as givers. I started my philanthropic journey when I was sixteen living in India. I didn’t have a lot of money and we started to volunteer time, and a little bit of money for me. It was $10 a month. It’s important that we feel lifted up enough. You don’t want to give when you don’t feel like you have. You never want to give them more than you feel you can give. That is true whether it’s of your heart, time, or money.

There’s a little paradox in that for me only because it’s my understanding and my core premise at this point in my mid-50s. I grew up in a very poor family. I did not have access to resources and no one had ever been to college. It was that whole idea of education and freedom. It wasn’t something that we had access to and didn’t know that access. My parents did their best to ingrain in me. I can do attitude and willingness to work hard. I’ve always been a good student. I’ve got a lot of gifts and a lot of things that have come through that helped me again when I couldn’t see myself.

The most successful people that I knew and that I’ve had the blessing of knowing throughout my journey at this point are people who were always generous of heart, generous of spirit. It wasn’t someday when they got wealthy that they gave. It was getting through the stretching through the expansion. There’s something in that for us. I believe that giving causes growth. It’s an interesting paradigm when women come to one of our programs and they want education on how to build a business. I asked them to make a donation in exchange for your education. There’s often a little hesitancy if that’s a new paradigm for them. They haven’t done it before. I say, “If you can afford to invest in yourself here, you can afford to give there.” What it does is it starts them being expanded. This is either they can, then they start being a whole different level of leader.

We’re saying the same thing. I feel that women often over give. In their homes, they say yes too often. That’s more of what I was referring to about, we do need to keep ourselves filled up emotionally, internally, and mentally so that we can then stand in our power in the world. What’s also funny is that you will never expand until you understand that being of service is the most important thing. When you are able to start to understand that, then you expand in every way. You expand emotionally in your capacity to give, your compassion, wisdom, personality and also wealth.

My husband learned something from me very early on. We were broke as newlyweds. I remember one day, we were talking about the budget and I said, “I still have to donate to the temple.” He says, “We pass on it this year.” I said, “No. We’re going to double it this year,” which frustrated him. For me, when I start to close down, to cringe, feel that I can’t do it, is when I open up even more because then that releases all of that. Now, money, energy and creativity start to flow.

It sounds like it’s your story. It sounds like it’s your truth.

If we've been blessed to have an opportunity to do well for ourselves, who else can we help so that they can do the same? Share on XDo you find that’s also true for other people?

It depends on where they are. There’s some truth in Maslow’s hierarchy of needs. When somebody is in survival mode, I’m always in awe, when I meet people who live on less than $3 a day, who find a way to give. There’s a place where a lot of times there’s a spiritual component that kicks in. Most people that I meet in the developed world are still running the myth of not enough, but they’re still trying to be more, do more, have more. Yet, if they can’t overcome that, then my conversation is not the right conversation for them. If they’re stuck in that, then all we can do is love and try to support them as much as we can with where they are.

What do you mean by a limitless woman?

Monica Nyiraguhabwa, who you’re familiar with, is also a donor for Girl Up Uganda through Kimberly Writing Women In Business Giving Circle. When I met this woman who’s in her mid-30s, I started to learn more about her story. She’s incredibly humble. You don’t know that until you start getting in there and digging in. She grew up in the suburbs of Kampala. She had her first pair of shoes at age thirteen. People may or may not know this, but in most places in the world, education is not free. She had to come up with school fees.

Her parents had to decide, “Do we send our son or daughter to school?” They decided to send their son because chances are, he would stay in the village versus her getting married and moving away from the village. She was resourceful. She started selling vegetables. She found a way to make her school fees. She started this at about age seven. It was mind-boggling to me. She went on the Government of Uganda partnered with the University of London and created a scholarship fund for five students in the entire country. There were 5,000 applicants. She was one of the five students who got the scholarship, went to England, stayed on for a Master’s degree in Public Policy, and then came back to Uganda to the slums. I mean no electricity, no water, no roads, no transportation, and decided to dedicate her life to lifting up other young women.

They wouldn’t have to be in a family where a family had to choose. That to me is a limitless woman. Everything that was presented to her was what we would consider I believe a limitation and she chose not to see it that way. She chose to stay deep in her faith to keep taking the next step that she could. She’s an Obama scholar, spoken to United Nations, on the Today Show. She’s right there in Uganda, in the trenches, making a difference for hundreds of thousands of girls. A lot of times when we face adversity in our lives, things that could be in way, perspective is important. For me, there’s nothing at this point in my life that makes me more excited than supporting a woman like that who’s out to change the world.

That was an amazing story. Thank you for sharing it.

She’s a limitless woman. That to me is the epitome of a woman who overcomes amazing adversity. An ordinary girl with extraordinary faith and perseverance. She chose not to just make it about herself. She has nine adopted daughters. She’s 36 or 38. She’s my relevant hero. I have many of them. It’s this work of how do we, as women, lift each other up? How do we as women continue to shift the idea that there’s any competition? There’s no competition. There’s a tremendous amount of abundance in the world. There’s a tremendous amount of resources.

If we’ve been blessed to have an opportunity to do well for ourselves, meaning that we’ve reached sufficiency. We’ve been able to take care of ourselves, our families. Who else can we help so that they can do the same? My family of origin could not help me past a certain point because they didn’t have any reference. They didn’t have any perspective. There were other people who saw me from the outside who said, “You can do this. There are other possibilities. Somebody has to open up and shine a light on what’s possible.” I feel like I’ve been very blessed. All the way plus up to this point, and as long as God lets me stay here. It’s good to be here.

Creating Notes: The epitome of a woman who overcomes amazing adversity is in being an ordinary girl with extraordinary faith and perseverance and choosing not to just make it about herself.

Laura, how can people reach you if they want to get in touch with you and find out more?

The easiest way to get connected with me is through the web. If you go to Free Gift Friday, you can opt in for a copy of my first book, Stop the Spinning: Move from Surviving to Thriving,where I tell my own limitless woman story, where I came from and where life has taken me. It’s a little bit of that journey and the power of the formula. The tools and the resources that I and the most successful women I know used to keep themselves on track financially, with the time, their operations, and community. You can always contact me through the website, LimitlessWomen.com. There’s a Contact Us form that comes right to me.

Ladies, I would go there and get that book. That sounds amazing. I know I’ll be doing that. Laura, are you ready for three rapid-fire questions?

Yes.

Give us one super tip on getting started in real estate investing.

One of the fastest ways that you can grow your real estate business is to get comfortable with using other people’s money. When you think like an investor, you look at how the profit on a property is made when you buy it, not when you sell it and you get clear about your numbers, metrics which all are part of the education. You can bring in business partners because everyone will run out of their own money at some point. If you want to keep growing, you want to keep expanding your business. Learn early on how to make it a win for other investors. A lot of people don’t necessarily have the time or inclination to get an education. If you’re one of those women who’s motivated by giving the education, understanding how to do this, and you partner with someone who’s an investor, who wants to get a good return on their investment, but they don’t want to have to do all the work, that’s probably the best super tip that moved us the fastest.

What would you say is a strategy to be successful as a real estate investor?

You have to get clear about what your revenue-generating activities are. If you’re not writing offers on houses, connecting with investors, and bringing in joint venture partners, not advertising your properties and finding leases, you’ve got to get clear to where are the actions that drive your revenue, not shopping. Shopping as fun as that is, that’s not always the best thing to be spending your time on. Get clear about your paradigms. Get your education in place, and then get into the actions that going to bring in revenue to your company.

What is one daily practice that you would say contributes to your success?

One of the fastest ways to really grow your real estate business is to get comfortable using other people's money. Share on XI’m a very faith-based person. A lot of conversations with God throughout the day and I never say never. Almost every day, I don’t get out of bed without a deep gratitude practice. I have an incredible amount of blessings. I’ve overcome an incredible amount of adversity by American standards. At the same time, I know that we get more of what we focus on. I’m constantly in prayer and gratitude for all the good things that are happening. I’m open-minded and allowing myself to be led to what the next step is.

I love how you talk about that. You’ve had a lot of adversity according to American standards. Let’s keep it in perspective.

As a child, I was sexually molested. I experienced a tremendous amount of abuse and domestic violence relationship in my late teens. This is the piece, not that those things weren’t hard. They were very hard and I always had a roof over my head and I had fresh water. Now, the perspective I have after working locally in charity projects humbles me. It tells me what people are capable of creating and achieving with little in the way of resources. I’m inspired to see how many of them I can continue to support.

Laura, I loved this conversation. Thank you for what you’ve offered to my ladies.

It’s my pleasure. Thank you for having me.

Ladies, thank you for joining Laura and me for this amazing limitless conversation. I look forward to seeing you next time. You know how much I appreciate you. Always remember, goals without action are just dreams. Get out there, take action, and create the life that your heart deeply desires. I’ll see you soon.

Important Links:

- Stop the Spinning: Move from Surviving to Thriving

- Limitless Women

- The Thriving Women in Business

- Monica Nyiraguhabwa

- Free Gift Friday

- LimitlessWomen.com

About Laura Gisborne

Hey! I’m Laura

An entrepreneur, philanthropist, writer, wine maven…

And fierce advocate for helping brilliant, passionate women like you mobilize their richest gifts into a business they adore that transforms lives and the world around them.

Working with me, you escape working harder and harder just to feel “good enough.” You shed the frustration of not being where you thought you’d be by now.

And instead, start living your greatest purpose. Far faster and with far greater ease, clarity and power to do good than you ever imagined possible.

Now, just in case you’re thinking “Sure, Laura, easy for you to say. You’ve already got the luxury of freedom and time. You’ve already got a string of successful businesses under your belt.”

To listen to the EXTRA portion of this show go to RealEstateInvestingForWomenExtra.com

To see this program in the video:

Search on Roku for Real Estate Investing 4 Women or go to this link: https://blissfulinvestor.com/biroku

On YouTube go to Real Estate Investing for Women

——————————————————

Learn how to create a consistent income stream by only working 5 hours a month the Blissful Investor Way.

Grab my FREE guide at http://www.BlissfulInvestor.com

Moneeka Sawyer is often described as one of the most blissful people you will ever meet. She has been investing in Real Estate for over 20 years, so has been through all the different cycles of the market. Still, she has turned $10,000 into over $5,000,000, working only 5-10 hours per MONTH with very little stress.

While building her multi-million dollar business, she has traveled to over 55 countries, dances every single day, supports causes that are important to her, and spends lots of time with her husband of over 20 years.

She is the international best-selling author of the multiple award-winning books “Choose Bliss: The Power and Practice of Joy and Contentment” and “Real Estate Investing for Women: Expert Conversations to Increase Wealth and Happiness the Blissful Way.”

Moneeka has been featured on stages including Carnegie Hall and Nasdaq, radio, podcasts such as Achieve Your Goals with Hal Elrod, and TV stations including ABC, CBS, FOX, and the CW, impacting over 150 million people.

Real Estate Investing Advice From A Financing Perspective With Jen Du Plessis

There are so many people who claim to know everything about investing, but unless they do it themselves and are on the ground, it’s better not to take their advice. Far from that, Moneeka Sawyer interviews someone who has a wealth of knowledge and experience about real estate investing. She brings over Jen Du Plessis, America’s Mortgage Mastery Mentor, to share with us some great investing advice from the financing perspective. Jen reveals some of the myths of financing and the things you need to know about local lenders while also sharing advice along the way. Believing that we can live our legacy while building it, Jen then reminds us to live a beautiful life and to play with passion.

—

Listen to the podcast here

Real Estate Investing Advice From A Financing Perspective With Jen Du Plessis

Real Estate Investing For Women

I am excited to welcome to the show, Jen Du Plessis, America’s Mortgage Mastery Mentor believes that you can live your legacy while you were building by working on purpose to play with passion. She is recognized as an influencer in her industry as the best-selling author of LAUNCH: How To Take Your Business To New Heights. Hosts of the top-rated podcast, Mortgage Lending Mastery, which I’d been on, and is a highly sought out and charismatic international speaker speaking on stages with such icons as Darren Hardy, Tony Robbins, and Les Brown.

She works with mortgage loan officers and real estate professionals who are overwhelmed, stressed out, and sabotaging their personal lives for the sake of their business to help them multiply the results in record time while having the courage to say yes to their personal lives which sometimes means saying no to clients. She has been seen and heard on Good Morning America, Sirius/XM Radio, Voice America, and Mortgage News Network, and has been recognized with the Women With Vision Award as one of the Top 20 Most Powerful Women in the mortgage industry.

—

Jen, how are you?

I’m great. I am excited to be here. We had so much fun on my podcast. I can’t wait to have as much fun on yours. We clicked well so it’s an exciting time and I’m happy to share whatever I can for your audience.

I was feeling the same thing. I get to talk to Jen again. I know that your focus is on helping real estate professionals do their job and run their businesses better but tell us a little bit about your investing journey.

I was investing way before. I have ten aunts and uncles. My mom was 1 of 10, five men, five women. All of the men are real estate investors. I was exposed to it since I was young. I was cleaning apartment buildings at Central Michigan University where they own a lot of property. My mom and dad were investors as well. They had a unique way that they did things. That was left to my brother and I when they passed away. We started our own investing. In fact, we bought our first home when we were nineteen years old. My husband and I got married a few months later.

By the time we were 24, we had five properties. At that time, it wasn’t popular for fix and flip and things like that. It was, buy the house and they were cheap back then. You’d save a little money and buy a house. Sometimes we pay cash or we had seller financing and stuff but we did step investing. Part of step investing is also that we didn’t need the cashflow. Therefore, all of the cashflow went back into paying everything off as we went along the line. Later, we traded in the houses for the hotels on the monopoly game and that’s multifamilies and stuff. These days, we’re doing Airbnbs and we’re doing subject tos.

We buy subject to properties. I’m excited about this new market and it’s sad because we’re in COVID challenge. While we’re in the COVID challenge, some people are going to lose their homes. I’m excited about the opportunity to help them, not just to take from them. Furthermore, I was training real estate agents for years and I would ask them, “How many of you own your own home?” I found that a lot of real estate agents never even owned their own homes. They got into real estate and never owned their own home. Those that did own their home, I say, “How many of you have investment properties?”

I can honestly tell you, of the eighteen years I was teaching real estate agents, less than 1% of them owned many homes. To me, that’s like me being a Mary Kay Consultant and saying, “I don’t wear makeup but you should wear makeup.” A sales guy saying, “I still riding on a horse and buggy but you should buy a car.” I found that they weren’t buying their product. I didn’t want to be in that position as a mortgage lender. I wanted to be in a position where I was buying the product that I was helping people achieve and obtain to grow wealth. One of my niches was doing investor loans.

I tell people this all the time. When you’re looking for a mortgage broker or you’re looking for a real estate agent and it’s for your investments, make sure their investors themselves because anybody can sell a house but somebody who understands what it’s like to be an investor, the things you need to look for, they’re going to be a huge asset. I don’t know how or why they do this but a lot of times, they’ll get in the way of you investing in a property because they don’t understand the process. It’s not a perfect home but as an investor, you’re usually not looking for a perfect home for you to live in. A lot of times they don’t understand that you don’t want to see all these condos where they have to be owner-occupied. They’ll keep sending you stuff and it’s not even a qualify for your strategy. It’s important that you are dealing with people that understand what you’re trying to do, and then that could be a huge asset.

I also think that when you deal with people that are in that space, they have their own teams. When your team isn’t available, something goes awry, or they’re too busy, it’s great to be able to tap into their teams as well and the resources.

Get your financials to pull together because the deal of the century comes around every week. Share on XThere are a lot of benefits to dealing with agents and mortgage brokers that get it. Since you’re in mortgages, talk to us about the myths of financing.

We were talking about this in the green room saying, “Are they myths? What are they?” I know that your audience is everywhere from someone who is thinking about investing all the way up to the experienced investor. I want to be careful. I don’t step on any toes on either side. I would say from the perspective of being a mortgage lender and being in the top 200 loan officers in the country, I know what it takes to get these loans done. If you’re starting, go to your local mortgage broker or mortgage lender.

Find someone who understands investments but go to your local mortgage lender. Don’t seek out hard money, private money, and all those things unless it’s a quirky property because otherwise, you’re going to be paying a lot more for it. I would say, start your journey with a traditional mortgage lender and then learn how that process works. For example, after a while, we get to the point where it was painful to get a mortgage and through traditional financing. What do we do? We went to the bank.

That would be your next step. Once you accumulate however many properties, it doesn’t matter, but you have ten mortgages on, you’re going to start running into problems with a traditional lender. That’s going to start scooching you into alternative financing or I call it situational financing where your situation requires that we look elsewhere. That takes you into banking and making it a small commercial loan.

That all by itself is trouble. Good luck with that one. Believe me, we’ve had to go through that and you have to do that as soon as you get past four units anyway, you start heading in that direction. That’s the next step. A lot of people came to me and said, “I’ve been working with this bank for seven months and we can’t get this two-unit closed.” I’m like, “What are you talking about?” It’s knowing that you may have to go through the banking environment. Once you get past the banking environment, there’s a little-known bridge that helps you do build the gap between banking and hard money or private money. Not all hard money and private money is bad.

It’s good but there are this nice little bridge and a lot of people don’t know about it. There are two pieces to it. One is in the mortgage space, there’s something called Qualified Mortgage or QM. This is as a result of Dodd-Frank because of the big credit crisis that we had in 2007 and 2008. As a result of that, everyone has to meet these qualifying mortgage criteria. If they don’t meet those criteria then there was nothing available except going for hard money or maybe finding a bank. They could do a commercial loan. In walks this non-QM, Non-Qualifying Mortgage criteria there are some loose guidelines in there and these are securitized loans. They’re safe. They’re securitized on the secondary market. It’s not like Susie Q out here, Joe Blow, or anything.

Those are good options. The only thing is, there aren’t as many investor options as there are owner-occupied. For example, if you had one day out of bankruptcy, you can get a loan in this as long as it’s owner-occupied. There were a few little non-owner-occupied that allowed you to have more financing on more properties which was not what the traditional lending does. That was a good sense and then we lost QM with COVID. A lot of people don’t know it because of forbearance, everyone stepped back and said, “We’re not going to give anybody a loan and let them not make their payments.” A lot of that has retracted but it’s going to come back and it’s still there. That would be the next step.

Residential, non-QM, banking, and then you get to the financing that I do. I call it situational lending. What I do is I have access to over 45 different lending investors that consist of hard money, private money, securitize money, buy and holds, fix and flips, multi-units, apartment buildings, mixed-used, all of that comes in there. Because of my mortgage experience I’m able to package these loans better than the average person that you would run on the street. I’m able to package these loans, then fish them out to the investors, and find out who’s most interested. Every one of them is case-by-case and I get a finder’s fee. That’s it.

They take over from there and I get a finder’s fee. This has been good for me as was good for me as a lender because if my investors came to me and they had no outlet, instead of saying, “Let me make some phone calls and see if I know Joe Blow down the street who will charge you 12% and four points.” This is a great way for me to move into that market. I’m doing that as well. I’ve got my own private investors and hard money guys too but I still seek them there. I would say, if you’re starting off in investing, I want you to know that there are a couple of gaps that can be filled with some financing and you weren’t aware of rather than going all the way to hard money or private money immediately. There are still options that are wonderful out there for you.

I want to backtrack a little bit to get more clarity. The first thing you said is to go to a local lender and then you said next, you can move to banks. I’m not sure what the difference is between that. Could you clarify?

What’s the difference between a loan officer, mortgage broker, and a lender? The name doesn’t matter for the individual. If you called me a mortgage broker, a mortgage lender, a loan officer, mortgage advisor, it wouldn’t matter. In fact, I was a certified mortgage planner. I have a certification like a CPA in mortgages just like they have in accounting. That doesn’t matter what I’m called. The institution for whom I work with is what’s different. Banks have loan officers sitting in their bank and sometimes, they are the bank loan officers where they can do residential and commercial. Sometimes banks have loan officers sitting in their branches and they are part of the mortgage division of their bank so they don’t do commercial. As a result, they’ll have a commercial loan officer and a residential loan officer still inside of a bank.

Investing Advice: Find someone who understands investments but go to your local mortgage lender. Don’t seek out hard money, private money, and all those things unless it’s a quirky property because otherwise, you’re going to be paying a lot more for it.

You move from there and you go to a mortgage lender. A lot of times, they’re referred to as correspondent lenders. Their staff, their loan officers, originate loans find and help you get a loan. The loan is underwritten to the guidelines of Fannie Mae and Freddie Mac and maybe another investor like Wells Fargo or Bank of America. A lot of different companies out there. This is how I use the terms, that lender funds using their warehouse line, their line of credit. They fund in their name, and then they sell to Fannie Mae and Freddie Mac. A broker is a loan officer, the same thing, but they don’t fund in their own name.

They originate the loan, they help you get the loan but they send the loan to Wells Fargo or another lender to have them underwrite, make the decisions, and fund the loan in their name. They’re a finder. A lot of people think that brokers are more expensive, banks are less expensive, or vice versa. The bottom line is we’re all the same. The pricing is all the same. It’s just the way it’s delivered. It’s about who you feel most comfortable with. I will tell you that when you go to a broker and you go to a lender, you’re going to have more options in investing, financing than you will when you go to a local bank. When you go to the bank, you’re going to have their guidelines. Some of them do sell to Fannie and Freddie but it’s a cookie-cutter.

Everybody else can do Fannie and Freddie anyway. Those are the rates that you see every single day. You have more options going through a broker and a correspondent than you do going through a bank. Here’s what I would say. I need a broker, a lender, and a banker in my repertoire. You need every one of them. There’s this thing called overlays. Fannie Mae and Freddie Mac put out a box that says, “These are our guidelines.” What happens is there are negotiations of overlays. You’ll say, “How come this lender can do it and that one can’t?”

It’s because it was part of the negotiation. It also might mean that it’s a little bit more expensive because it is a little off, stretching your Band-Aid, or a rubber band, your box. I would have all of them in my repertoire and then I would have the private lender, the private money, or the hard money. Now, I’m introducing two other entities which are the non-QM loan officer who does that type of financing as well as the type of financing that I’m doing which is completely different. I don’t do anything owner-occupied at all. Everything is an investor.

You said you’re the finder, what exactly are you doing? Tell me about what this looks like for my ladies that might want to call you on that.

I had a call with a client and she’s looking at buying an 84-unit apartment building in Atlanta. She has somewhat of a portfolio. She still has to get me some documentation to figure that out. What happens is that I collect all the documentation, I build the package not just in tax returns and things like that, but in the DSCR. I make sure what that is. I made sure I note the comps are out there. They have the experience and I’m building their bank statements, their pay stubs, and everything about the property. I’m building that presentation as well as behind the scenes like, “What do they want to do with this? What is their exit strategy look like? Is there an exit strategy? Is this a buy and hold? What are we trying to do with this?”

I then present that to 40 different investors and say, “Who’s interested.” Everyone goes, “Me.” Believe it or not, there’s this big world out there that most people don’t know about but it’s all done digitally. I upload all the information digitally and then I get back 3 or 4 different people then I hop on the phone and get through the details and make sure that this is an area that we can send to them. They write a letter of intent and then I introduce the two parties to say, “Here you go, take it from here.” I don’t get involved with any of that side of it anymore.

I’m the guide who brings you there and says, “Here are my selections of investors. Which ones do you want to invest in your lenders? Which terms seem to be best for you? You can move forward with that.” I’m building that whole package. Here’s what’s funny. A lot of times, there’s no appraisal required, it’s an equity loan. A lot of times, no credit is required, down payments are required but no income verification. Those were the old days but that was through traditional financing, that is gone, and that is not coming back.

What’s coming back is this new hybrid for investors of no income verification, no asset verification. Sometimes no credit or 10% down on an investment property which you can’t get through Fannie Mae and Freddie Mac at all. It’s cool because people value those investors who have experience and know what they’re doing. If you don’t have the experience, that’s okay. You might have to put 20% down but you’d have to do that anyway. They value the experience that investors have. I reward them by making it easy.

Are the rates competitive?

The rates are extremely competitive. I don’t have any issues with any of the rates. They’re scalable depending on the term, sometimes credit score, down payment, how many units. Also, where you are, is there a metropolitan area around you or are you to find something that’s out in the country that’s 84 units. That’s going to have a big play on it as well. As you know, rates are in everything when it comes to investment. It’s about the numbers. My company has lent my other company money at 18% so I can make more money. It’s a different area. I needed the write those on one and I needed the income.

We can live our legacy while we are building it. Share on XAre those longer-term loans or do they have to be paid off in five years? Does that work?

It ranges. The fix and flips are totally different, 6-month, 12-month, 18-month renewals up to 24 and 36 depending on the situation. The buy and holds are 30-year loans. What we’re looking at for her is a 30-year loan on an apartment building.

That’s unheard of. Are you affiliated with a particular company doing those loans?

It’s my company. Whoever else does this, we all pack into there. This was out of a need for my own need to find alternative financing. I stumbled upon them a few years ago. It’s been a Godsend because there have been some great opportunities. In owner-occupied, I’ve had some traditional loans fall apart. Not in this context because it was owner-occupied but I’d be able to go to my private money lender and still save the deal, refinance it later. It’s a great opportunity. It was out of my own need and that’s how I stumbled across in it. It continued to grow with the fact that investment has continued to grow. There’s more confidence, more data to support the fact that we know someone who has one unit is going to perform differently than someone who has 100 units of properties. There’s common sense in there. There certainly isn’t in residential anymore. It is a cookie-cutter.

Are they still lending during COVID? A lot of the lending money has dried up like you were saying with the non-QM.

In traditional financing, non-QM and Jumbo is gone. There are very few places that are doing Jumbo. I’m not even in the business. This is how I love knowing. Freddie Mac came out and said that they’re going to be reducing their high balance conforming. This is a big problem in a lot of high ticket areas. I live in Loudon County which is the wealthiest County in the United States of America. These loans that they’re talking about, they already have taken away because of COVID and they’re talking about taking back the next layer down because of COVID, these are cookie-cutter houses and it’s going to impact our particular area.

Other areas like Florida where the house values are substantially lower. It’s not going to have an impact. There’s still lending in the non-owner-occupied in the investment space. We had a lot of retraction and then it came back again. We had a retraction again with forbearance when that came out. It dabbled back in a little bit. We lost a chunk of investors that we would have. We’ll have them back eventually but forbearance on a commercial is completely different and what is perceived to be a commercial even if it’s residential is completely different than a residential property. It has more risk. That was a blanket policy.

There’s an awful lot to think about around lending.

This is why you need to get with someone who knows what they’re talking about.

That’s exactly where I was headed. Sometimes you read this stuff. Ladies, you might be reading this and going, “My head just blew up. I don’t even know what they’re talking about.” That is true. Even for me, every once in a while, someone will come on the show, “Jen said a couple of things.” I was like, “What does that mean?” I was a mortgage lender. Things are changing all the time. Ladies, don’t get intimidated. The key is to find some people that are investors themselves so they’re interested in this financing that’s going to be a little bit different. It’s going to have different rates, different opportunities, different languaging, and you want to make sure that you’re talking to somebody who understands it themselves so that you’re not having to educate them. They can educate you and take a look at all the options.

Educating on your timeline, your time clock, and your money. I would say if someone is reading this and they’re thinking about buying something that isn’t going to be traditional financing for whatever reason whether it’s the condition of the property, the type of the property, location, or no longer qualifies for traditional financing is to get with me or someone like me in advance. Get your financials to pull together. The deal of the century comes around every week. Anytime it comes around, you aren’t starting from scratch. You get your ducks in a row.

Investing Advice: When you go to a broker and you go to a lender, you’re going to have more options in investing, financing than you will when you go to a local bank.

You said something interesting. There are many times we go out and we look at a property and we’re like, “I have to have this one. There’s never going to be another deal like this one.” The same thing will happen next week or next month. There is no such thing as a deal that you have to have. There are good deals that come up. You want to make sure that you put yourself in a position that if you find an amazing deal, you can take it. If you find an amazing deal and it’s not awesome, you can walk away because you’re set up to do another one. You don’t have to make bad decisions because you think this is the only deal and you’ve got the financing set up for this deal. You want to make sure you are positioned to make the best choices and buy the best properties for your strategy.

Hurry up and stop or stop and hurry up. Both ways are crazy. Getting a call saying, “I have to close in ten days.” Good luck. I can do that on a subject to but I can’t do that in others.

Tell everybody how they can reach you if they do want to ask you questions.

The best way to reach me is [email protected], that’s my email address. Reach out to me and say, “I’d like to have a conversation and get my ducks in a row for something or have you explained this. Not so fast.” I’ve been doing this for many years so I know what I’m doing but have that conversation. You might want to talk it through and say, “I’m not ready to do anything yet but I want to understand it a little bit more.” I’m happy to answer your questions especially as women, we need to be lifting, supporting, and leading each other up. That would be the best way to get a hold of me.

Thank you for that. As women, we do need to be lifting each other up. It’s important. Thank you for offering your time. We’re going to go into our three rapid-fire questions but before that, let’s talk a little bit about what you’re going to be talking about in EXTRA. I know you got some juicy stuff so why don’t you share those.

As my bio said, I believe that people can live their legacy while they’re building their legacy. Often, we’re laser-focused on building and not having this beautiful life at the same time and then dying and not the life, or retiring and then passing away not too many months later because now that purpose has gone. I believe that we can live our legacy while we are building in it but it requires that you’re working with focus so that you can play with passion. That working on focus for me is mastering your priorities so that you can be the master of your life. If it takes you an endless amount of time to do something then you will take that endless amount of time to do it but if you have a timeline, you will finish it. If I gave you 5 miles on a flight path where you had to take off, you would take the whole 5 miles. If I said, “You have to get this plane off the ground before you hit that tree 100 yards away.” You would do it.

What I do is I help loan officers, realtors, and investors how to prioritize everything in their lives. I call it Lifestyle Business Mastery so they can have the best of both worlds. In real estate investing, when the gurus say, “You can be an investor, you need one hour a night to dedicate.” You’re sitting there and going, “What am I going to do in that one hour? I don’t have a plan. I don’t have a strategy. I’ve got all these kid things going on and I can never get to it.” That’s what we’re going to talk about is some of the steps to take to start getting in that direction. I have four businesses, they’re all doing well and it’s because I know how to manage my priorities. I don’t do things that aren’t going to move me forward and serve my greater purpose in life and the outcome I want. That’s what we’re going to talk about.

We’re going to be talking about lifestyle, business, mastery, and EXTRA. That’s going to be amazing. I’m excited about that. Tell us one super tip on how to get started investing in real estate?

Know what type of real estate aligns with your core values, your passion, and your financial wherewithal right now.

What is one strategy for being successful in real estate investing?

Draw a line in the sand for your cashflow, don’t waiver. If your cashflow is every house has to cashflow $250 then do not sign the contract for $249, $9.99. Don’t do it.

Working on focus is mastering your priorities so that you can be the master of your life. Share on XThere’s this line and we have to cross it.

You do not cross this line ever even, “I love the house. It’s cute.” Do not cross that line because once you start crossing it, it becomes a habit and you make bad mistakes.

The next one is, what is one daily practice that you do that you would say contributes to your personal success?

For me, it’s time management, it’s priority management. I get up and I know exactly what I need to do. I get in, I get out, and I go play. That is the key to it. If you master your priorities, you can become the master of your life. We all have the same 24 hours. I maneuver within them quite different than other people to everything that I want to excel. I don’t care if it’s personal or business. If I want to excel something, I maneuver that. I mastered those priorities and make the right choices. It’s small choices that can bite you. They’re like mosquitoes. The constant small choices versus the big elephant. It’s not the big choices that hurt you, it’s the small ones that hurt.

I can’t wait to hear more about that in EXTRA.

I can’t wait to share it. Come on over.