Setting Up Your 2025 for Success!

Moneeka Sawyer is often described as one of the most blissful people you will ever meet. She has been investing in Real Estate for over 20 years, so has been through all the different cycles of the market. Still, she has turned $10,000 into over $5,000,000, working only 5-10 hours per MONTH with very little stress.

While building her multi-million dollar business, she has traveled to over 55 countries, dances every single day, supports causes that are important to her, and spends lots of time with her husband of over 20 years.

She is the international best-selling author of the multiple award-winning books “Choose Bliss: The Power and Practice of Joy and Contentment” and “Real Estate Investing for Women: Expert Conversations to Increase Wealth and Happiness the Blissful Way.”

Moneeka has been featured on stages including Carnegie Hall and Nasdaq, radio, podcasts such as Achieve Your Goals with Hal Elrod, and TV stations including ABC, CBS, FOX, and the CW, impacting over 150 million people.

Become the Bank for Passive Real Estate Income – Buy Notes

Moneeka Sawyer is often described as one of the most blissful people you will ever meet. She has been investing in Real Estate for over 20 years, so has been through all the different cycles of the market. Still, she has turned $10,000 into over $5,000,000, working only 5-10 hours per MONTH with very little stress.

While building her multi-million dollar business, she has traveled to over 55 countries, dances every single day, supports causes that are important to her, and spends lots of time with her husband of over 20 years.

She is the international best-selling author of the multiple award-winning books “Choose Bliss: The Power and Practice of Joy and Contentment” and “Real Estate Investing for Women: Expert Conversations to Increase Wealth and Happiness the Blissful Way.”

Moneeka has been featured on stages including Carnegie Hall and Nasdaq, radio, podcasts such as Achieve Your Goals with Hal Elrod, and TV stations including ABC, CBS, FOX, and the CW, impacting over 150 million people.

Real Estate Investing As A Way Of Taking Control Of Your Wealth With Victoria Lowell – Real Estate Women

When a couple is looking for a house, it is not the man who has the final word. It’s the woman. Women know what to look for in houses, which would mean that they have the potential to invest in real estate. Maybe they just need to be introduced to it or to learn about it. After all, women are naturally good at handling money. Join your host, Moneeka Sawyer, and her guest, Victoria Lowell. Victoria is a financial coach and the founder of Empowered Worth, an educational platform for women to control their own financial future. In this conversation, they talk about empowering women in real estate, taking us through retirement planning, maxing out the ESPP, real estate debt, cheap money, and more. It is time to remind women of the power they hold when taking control of their wealth. Follow along as Victoria shows you through real estate investing.

—

Watch the episode here

Listen to the podcast here

Real Estate Investing As A Way Of Taking Control Of Your Wealth With Victoria Lowell – Real Estate Women

Real Estate Investing for Women

I am excited to welcome to the show Vicky Lowell. Vicky is a financial advocate and coach, international best–selling author and the Founder of Empowered Worth, a financial education platform that empowers women to become active participants in their financial future and wellbeing. She is also the author of the international bestseller Empower Your Worth: A Woman’s Guide to Increase Self Worth and Net Worth. Her expertise in this field has led to her hosting a college planning seminar at the University of Miami in 2021 with several speaking opportunities planned both locally and nationally. Welcome to the show, Vicky. How are you?

I’m excited to be here to talk about women, finances and real estate investing because that is part of it. We have to diversify. That is a great way to do it. I am super excited to be here.

Women are naturally, by default, better predisposed to be successful in real estate. Share on XAs soon as you applied to be on the show, I was, “Yes. This is the woman I got to talk to.” I’m glad you are here. Vicky, could you give us a high–level version of your story? Tell us how you got to where you are.

I’m going to do like Sophia used to say, just the facts. I was the quintessential stay-at-home mom, living in Greenwich, Connecticut, has been in finance, two kids, nice car, great house. 2008 came, the market crashed. I found myself turning to my husband, my college sweetheart, we are still married, saying, “What is a mortgage?” He’s like, “Our mortgage payment?” I have no idea what the mortgage payment is. I have no idea what the car payment is. I have no idea what it would cost to run this household if you were to lose your job or drop dead tomorrow. I got to college but my college degree has been hung up on the wall. I have forgotten about it. It was my a–ha moment. I said, “I’m going to figure this out. I’m going to get back into the workforce. I don’t like being a stay-at-home mom that much.” I was doing what was expected of me as a Cuban. I changed the narrative. That is what I did.

I went back to school for a little while. My husband came with an opportunity to work for him. He is a financial advisor. I started off as the marketing girl because that was my background. I ended up loving the women I was working with. I became a financial advisor. In 2019, I decided to start Empowered Worth. I decided that I was tired of women being in need. That was the empowerment for women. They weren’t connecting with their finances and I needed to be part of the solution. I couldn’t do that as a financial advisor. I didn’t want to have my desire to help tied to needing to get those assets under management and have people feel icky about it. It felt like a conflict of interest to me. I started an educational platform. It’s on–demand courses and coaching that women can get so that they can feel empowered and they can empower their worth. That’s why I wrote my book. 2018 was an epiphany. I set my first child off to college and I gave birth to Empowered Worth.

It’s interesting that you came from a financial planning background. We are talking about all the standard financial planning products. You moved out of that. We are talking about real estate as a part of diversification. Talk to me about your relationship with real estate.

I have a mother who frankly helped establish my family’s net worth by doing real estate investing. She didn’t realize that is what she was doing. She would drive around. She would get the pickup line. She would be 30 minutes early. She would drive around the neighborhood, look at houses and would buy them. She would fix them and flip them. She made herself a nice portfolio of real estate. That is something that I saw growing up. As I became a financial advisor, a financial planner and did all those educational parts, I realized diversification is key. When we talk about real estate diversification, a lot of times people think, “I’ll invest in a REIT or I will do something like that. That is on the market.” Those are great ways of doing it but for women, we are tactile. We would like to see what we are investing in. That is why real estate investing is crucial. I love to do it. I know what is selling in my area. I know what works. I know what I can get out of it. Why not have that be part of your investment strategy? It does make sense. The land is right there. You own it. No one can take that away from you. That is something that resonates with the female investor.

How do you invest? What is your strategy?

My strategy is diversification. I like to buy and hold things for a long time. When it comes to real estate, I have purchased something a little bit further up from where I am in Miami. It’s a great price, markets shooting up here. I know it’s going to rent well. I’m very intrigued with the Airbnb, VRBO market. I have had the opportunity to speak to some people on the board of VRBO. They are seeing huge growth. This is a great little niche to get into. That is what I did. I said, “Let me get into that.” I have never done that. I shy away usually from property management. I saw my mom have four stories. This is the time that it makes sense. People are going to look at traveling in a very different way post–COVID.

A lot of people are doing VRBO and Airbnb has been a rough year. People are, “All that income is gone.” That is interesting that you are looking at that. There is probably an entry–level opportunity again. Is that what you are thinking?

Yes. I have been able to take advantage of some of the people who were in it, who couldn’t ride the wave of the travel stoppage in the United States. In certain areas, I have seen people talking about it in ski communities. I have seen people talking about it in Orlando where you have Disney World. Not everybody wants to stay at a hotel especially if hotels aren’t giving you those extra little amenities. You can stay in a home. You know who has been in there. It’s usually sanitized well. You feel safer and you get a little bit more for your dollar. That is where I’m seeing. It’s a great way to start, buying an area for me that I know is going to go up. Being able to VRBO or Airbnb allows me to defray that cost and be able to hold it so I can be there as it grows.

How would it look to scale that? I have done Airbnb, too. I had one room in my house. I was in more of a corporate environment. We were walking distance to Google, walking distance to Box, driving distance to Facebook. We were right there. People would come for more corporate stuff. I have never had to scale that. Could you talk to me a little bit about what that might look like? I know that you are starting but do you have a plan?

It depends on location with any real estate. I happen to have a friend who went from being a teacher to being a full–time Airbnb, VRBO person. She now runs a property management company. She will literally grab other people’s and manage it while they put it on Airbnb. It’s very scalable. It all depends on where you are doing it and if the demand is there. For those houses, it makes sense to get 2 or 3 houses to start off with especially now, interest rates are at an all–time low. Get an arm that will allow you to have a low–interest rate. You are doing that. The biggest issue I have with scaling it is who is going to manage the property for you.

That’s where before you do anything. That is what I did. I researched property management companies because I was not going to manage this. I don’t have enough time. I have got a husband, children and a business. I found a great property management company. That is key and making sure to talk to people who are doing it, talk to other Airbnbers or VRBOs, whatever it may be. Talk to them and see who they are using and get that referral. That word-of-mouth referral is crucial.

Control Wealth: Women are usually the ones who flip and sell houses because they know what other women are looking for. Very rarely does a couple come in and the man says, “It’s this house.” She is going to say that.

We are on a complete tangent from what we expect that we were going to talk about but this is fascinating to me. The other thing is these management companies. What do they normally charge to manage a VRBO or an Airbnb?

I have seen everything from 8% to 10% of what you are charging daily. It all depends on the level of what services you are going to provide for your Airbnb or VRBO guest. If you are doing a very full Millennial. They’re going to have a basket. They are going to have pretzels and stuff. You’re going to be doing that. You could be filling the refrigerator for them. All of that will add on. That is going to cost you if you are providing that type of service. You should probably get that back with what you are charging. That all depends. I have also learned everything from what a good property management company because they are going to be the ones that are going to list it on Airbnb for you. They want to see in your rental. They are going to want to see, are there stainless steel appliances? What does that kitchen look like? What does the furniture look like? Are you a standard? Are you a premiere? Are you platinum? All that type of stuff goes into it but it’s a lot of fun. I don’t have fun picking stocks the way I have had doing this.

Thank you so much for going on that tangent with me. That was fun. Your whole thing is about empowering women financially. Talk to me a little bit about how that works and what that means to you.

What it means to me is changing that horrible narrative that women have had for years, that we have to get married and have our husbands manage our finances or that we can’t grasp high–level finances. Women are great at the day to day. Women are great at budgeting, statistically. Every bank on Wall Street has a report on this. You can Google it. Merrill, UBS, anyone you want to look at. Google women, they have done a report. Look at those statistics. They are the same. It’s shocking. 80% of those women are great at budgeting. They can tell you what the kids spend on orthodontia. They can tell you what’s being spent on groceries. They can tell you all that stuff but ask them a high–level personal finance question. Ask them, “What is your retirement plan? Where are your IRAs? What is your 401(k)? What are they invested in?” They can’t answer that. That is the narrative that I want to work to change. When you ask women, “Why aren’t you engaging?” “I don’t feel confident.”

That’s where Empowered Worth was born, to give women confidence. I want you to know that we are there for you. We are your coaches. We are the women who have your back in the financial world. You can feel comfortable coming to the financial table, talking to a financial advisor or getting your feet wet in what whatever type of financial investing, be it real estate, markets, equities, bonds, whatever it is. I want to give women that confidence because that’s where it all starts from. That’s self–worth and confidence leads to an increase in your network. It all ties in.

You are of the opinion that women gravitate more to real estate than to the markets. Could you talk to me a little bit about that?

Time and time again, when I was a financial advisor, I would call in and I’d say, “Why aren’t you coming to the meetings? Why aren’t you doing this?” She’s like, “I am involved. I have been doing some stuff.” What are you doing? “I have been buying houses and flipping them.” A lot of women were into the whole flipping market thing that we saw in 2008. They may have shied away a little bit but they are usually the ones because they know what other women are looking for. Consumer spending decision, the women decide what house to buy. Rarely does a couple come in and the man says, “It’s this house.” She is going to say that.

As a woman, when you are the one prepping, staging that house, doing the remodeling of the house, you are literally your market. It’s very easy. You also know the neighborhoods because those are your neighborhoods or it was your past neighborhood. You are buying something where you grew up, where your parents sell it. You understand that in a much more tactile way than the obscure investors buying something. That is where that power is and why they gravitate to it because they are selling to themselves.

I have been saying on this show all the time that we are naturally by default better predisposed to be successful in real estate. I have also heard this statistic that the multi–million, multi–trillion–dollar real estate industry, still in investors, there is only about 40% of the investors that are women. What that tells me is, we are more likely to gravitate to real estate. We are still only 40% of the market. We are a tiny little percent of what the people that invest in the markets. Would you say that is true?

I would think so. It goes back to confidence. What is holding them back? It might be access to funds. It’s whether or not you feel comfortable pitching to your husband. Let’s say you are the stay-at-home mom like I was. I don’t know if I would have felt comfortable back in 2008 telling my husband, “Can I have $60,000 for a down payment? I saw a great property and I’m going to flip it.” I don’t think I would have done that. A lot of women may not even know a lot about lending structures and how to get those sources of income. They are a little bit hesitant.

Self-worth and confidence lead to an increase in your network. Share on XOnce you get past that and you buy your first home, it’s a learning curve. Once you get there, you will do it and do it again. It’s like a drug. The women I know who are doing this are literally addicted. They are buying by the owner, which is incredible. A lot of them are buying by the owner or they are getting their realty licenses because they want to take that middleman out and keep that commission. It’s amazing. You can do that. That is the great thing about real estate. You can be a stay-at-home mom, have a job and it can be your side hustle or it becomes your main hustle. You can do that.

Talk to me about retirement planning for women.

Retirement planning for women is something that is an uncomfortable conversation and we need to have it. Women are incredibly underfunded for retirement, for a multitude of reasons. First and foremost, being the pay gap that we suffer in this country. Women are making less. We step out of the workforce. That is the very well–known mommy penalty. We don’t necessarily accrue the funds that we need to have by the time that we reach retirement. It’s scary, unless you have a partner who’s thinking, “What happens when my counterpart retires? Do I have enough money saved in my 401(k) or IRA to cover both of us?” You may be incredibly underfunded. In addition to that, Social Security is not going to get you there. Everybody understands that now. We need to embrace that. It’s not going to be enough even to add on to that 401(k) and IRA. We need to have that conversation.

Last, the divorce rate. For those over the age of 50 are double what they are for everyone else. What happens when you get divorced at 50? You lose 50% of those retirement assets. Walk out the door because it’s the divorce. You’re going to get 50%. You don’t have the years of working to replenish that type of retirement savings. I’m always telling women, you are probably going to come into the workforce. That is the nature of the game. We have children. We caretake for spouses, children, our parents. You may not have that work trajectory in the workforce, increase and maximize your retirement savings when you are working. Give the max. If your company matches, give as much as you can. It is better to spend the money from your paycheck on retirement accounts than to go out and buy that purse that you are not going to have in ten years. You can’t eat the purse when you are in your 50s. Let’s be honest here.

Talk to me about filling that gap on the mommy penalty. What do you do to make sure you are maxing out the matching of the 401(k)? I like to talk about making sure you are maxing out your ESPP, which is the Employee Stock Purchase Plan. Those are some of the things that we do. What are the things that you talk about?

Those are great. Those are definitely ones that people need to think about. If you are in a situation where you are a stay-at-home mom, sit down with your spouse. If it’s feasible for you and your budget, talk about a spousal IRA. As an individual, if your husband is doing a 401(k), your partner is doing a 401(k), I get that there are benefits. There is matching. There is corporate stuff but you can still get a spousal IRA. We definitely have that conversation. It’s something you should think about. I’m all about the side hustle. Even though you are not working doesn’t mean you can’t be working. Think about it, there are 1,000 things.

With COVID, a lot of women have turned to their side hustles to add money. I know a lot of friends who are making jewelry and doing well. Does it surprisingly sell the same as the day–to–day work that they had before? No, but it’s putting food on the table. Think about that side hustle and stash that money away for your retirement. Do not take a vacation with it. Do not spend that money on a gift for your husband. That money is there to provide for you. In that side hustle, I include real estate investing. Save a little bit. My mom got her first amount of money that she used to buy her property by all the money she skipped off the groceries. She is probably going to kill me that I said it. I had a dear friend once who told me my husband never looked at the grocery bill. I’m knocking out $50 a week off the grocery bill. She bought a great property with it. That is a great way of doing it. Think about ways that you can skip and get some stuff there. Put it in a retirement account.

This is how things went for me. My husband is a software programmer. He has his normal job. We have made a decision that he would pay for this day and I would pay for the next day. I was planning for the future. He was paying for our lifestyle. We still have the 401(k)s. Everybody knows that the 401(k), those programs are still not going to retire you. We were very aware and we embraced early on that Social Security was probably not ever going to be around by the time we retired. I wanted to do the whole real estate thing. I grew up in that. I trusted it but my husband, not so much. The way that we did that whole conversation was we owned a piece of property. He knew that you should buy a piece of property. We worked those numbers. Why pay rent? Why make somebody else rich? We did that and then as an appreciated, I negotiated with him that any money that we get in real estate, I want to keep it in real estate and have it continue to work in real estate.

As equity grew, I took out an equity line. He is very conservative. He was like, “Real estate money needs to make money in real estate.” We took out up to 80%. I take that equity and I invested in more real estate. That is how we built our portfolio. What’s interesting about that is it required little for me. You have to live in our house, which we were doing. We had to let it appreciate. I had to pay attention enough to know when I could pull money out and buy something else. It was a slow process. It was my side hustle. I will say that is what is going to retire us in the end. It happened in fifteen years for us that we live in an appreciation market in California. Everybody doesn’t have that same experience. Sometimes you have to be a little bit more aggressive in there. For us, it was the side hustle that required no hustle. There was nothing. I did this natural thing. The whole argument about real estate money, staying in real estate, won him over and has provided the retirement venue for us.

That’s true. I go back to this. Women need education into what the lending options are. Let me get the equity line. Let me do that. You can write off your taxes. There is so much stuff that you can do. There are sources of money out there. You need to figure out how to structure that debt. People hear debt and they start sweating bullets. I’m, “No. There is bad debt. That is your credit card on Chanel bag you can’t eat. There is good debt and that is real estate debt.” I’m not worried about real estate debt because you own the land. You have this. If it makes sense, if you are doing it right, structure correctly, you are going to see a growth in your net worth.

Control Wealth: There’s good and bad debt. The bad debt is your credit card on that Chanel bag you can’t buy. The good debt is the real estate debt.

The other thing about real estate debt versus consumer debt, which is credit card debt, cars. Real estate debt is leverage. If you think about it, you put 20% down and get 100% access to any money that the property makes. If you put 20% down and the house goes up, it appreciates by $20,000, you get a $100,000 home. You put $20,000 down. The house appreciates by $20,000, you made 100% on your money. Who took most of the risk? It was the bank. You got very little risk for huge potential. The bank is asking for a little interest rate. When it was at 17%, relatively speaking, that was a small interest rate in comparison to consumer debt. It’s cheaper money. You get to write it off. There is a bunch of benefits that the government gives you. People are like, “I don’t want to be in debt.”

If you have to pay cash for a house, you don’t want to be in debt, you are using cash. You are not utilizing leverage. If you make $20,000 on that house, you’ve made 20%, not 100%. You’re not using all of the benefits of what real estate can do for you. This is what you are talking about with the higher–level conversation. Most of us understand debt, no debt, cash and loan. What we don’t understand is that there are ways to leverage so that debt is good debt. I will be the very first to say we do not pay for anything on credit cards. It is simply a budgeting tool for us. We paid every single month. I never pay for a car with a loan. I don’t lease cars. There is this whole argument of the opportunity cost of where I could invest it. I don’t do consumer debt. I just don’t do it. That is one of our rules. I am completely leveraged on all of my real estate because it’s cheap money. It makes me a ton of money. Buying a car does not make me money.

I love that you said this. I say this all the time. When I was a financial advisor, people come in and be like, “I’m going to pay that house off.” I get that. There is a lot of books that say you pay the house off. We are going to take the money that is growing in this account that we have that you are invested in. We are going to pay off this debt that costs you this much. Why? You are losing all that growth by getting rid of this debt that does not cost you what your returns are costing you. You need to understand the numbers behind it and sit down. That is what I live to do, to explain it to people because they get scared. They hear all this noise and it becomes like that Peanuts show then they tune it out. There are a lot of ways to invest especially in real estate like you are saying and have it be a moneymaker for you.

I would love to have that conversation about cheap money on this show. We haven’t done this. My husband and I have talked about it all the time. He keeps saying you need to have this conversation on your show. Let’s talk about this. What do we mean by cheap money? What do you explain it? I will jump in because I know you know how to do this.

What we are saying by cheap money is I look at the opportunity cost. What is borrowing that money going to cost me? The example I was giving. Let’s say you have a great stock portfolio and it is growing at 10%. I’m going to use easy numbers here. You have the opportunity to put 20% down and get a mortgage on a property of X, map 2%. It makes sense for you to do that because the cost of borrowing that money is less than you paying the house off full and holding out the full amount of the house. You are taking that growth of money that you would have had. That’s what people should understand. You are losing the growth opportunity by putting it and paying it off.

What you are doing is you are paying 8% to pay off 2%. What you want to do is it the other way around. You want to pay 2%, get the 8%. This is the thing that I want you to know. Let’s get clear on this. Let’s say you pay taxes on that. It’s not long–term or short–term. Let’s take it to you earning 6% or 5%. Your mortgage is at 2% or 3%? Do you want to take the 5% that you’re earning and pay that money so that you can pay off 2%? That’s like saying, “I’m going to take $100 that my dad gave me to pay off $20.” Why would I do that? If my dad gives me $100, I’m going to pay something off. It’s going to be a lateral. Once I spend that $100 on that, $50 is gone. Why did you do that? You wouldn’t do that.

If you truly understood it, you would never do that. The same is true for people who say, “I’m going to borrow the money and I’m going to take the money out of my 401(k).” Why? You are going to pay penalty and taxes. Do you have to do all this to pay for this whole? No, you have enough of the down payment. Do that. Get the mortgage. Leave the retirement account alone and pay the mortgage off. There are some great mortgage options out there. I haven’t looked at them when new numbers come out. This is something that I have heard a lot are talking about, the fifteen–year arm. A lot of people aren’t holding their homes for fifteen years. Look at your age, if you are in your twenties, you are not going to be living in the house for fifteen years. Most people don’t live in the house. Why would you get back an interest–only fifteen–year arm and let your money work for you? I wish more people would have that conversation. I wish the mortgage lenders would explain it better. I wish that there was more financial planning and it was taught how money works for you.

Think about your side hustle. Even though you're not working doesn't mean you can't be working. Share on XThat is one of the questions that I get most frequently especially here in California. People are investing. “I got a $1.5 million rental property. I’ve got $1 million loan. How am I ever going to pay that off?” You are never going to pay that off. It’s not cheap money. That is not something you should be paying off. What you want to figure out is how are you going to cashflow that? Paying off, when you are talking about mortgages unless when you are doing end-of-life planning, you want to have no mortgage. You want to be able to live at your least expensive. It makes sense. It shouldn’t even be part of the conversation because it’s a write–off. It’s something that is helping you to grow appreciation. It’s getting you cashflow. It’s cheap money.

I do agree with that. Once you are hitting that retirement age, once you are 65, 66, 67, that is the time to talk about paying off your primary home. We don’t have those secondary. Make sure you have everything in the LLC and title the way it should be for asset protection. If you are doing all of that then definitely don’t pay off those mortgages on those rental properties. There is no reason to.

Thank you for having that conversation with me. I can’t have that on my own. It needs to be a little bit of back and forth.

It’s my pleasure. I hope everybody understood what Moneeka said. You are going to be ecstatic once you do because you are going to make money.

We are going to get into our three rapid–fire questions. Before we do that, I want to let you know ladies, we are going to be talking in EXTRA about how COVID affected women financially and what are the repercussions and consequences are going to be for several years after that. We are going to have a conversation about that. It is a gift and another tough conversation that a lot of us are looking at. I love that Vicky is willing to have the tough conversations to help us grow, empower us, build what we need to build. We are going to have that conversation in EXTRA. Before we move on towards the end of the show, Vicky, could you tell everybody how they can get in touch with you?

The best way to get in touch with me is to visit my website, www.EmpoweredWorth.com. Everything is there for you. You have a great blog that comes up once a month. Join our free membership. It gives you great basic personal financial education on demand. You can do it at your leisure and some great other little things that we add in there monthly for you.

You have got a free membership. You said that you were going to offer my ladies a fifteen–minute session with you.

Yes. I have it on there. I call it the Fifteen Free Intro Coaching Session. If you have any questions, you get to pick my brain for fifteen minutes. You would be surprised how much we can get done in that time. I would love to hear from you, ladies. If you have any questions, if you want me to explain the money to you, I will do that. I will run you through it. I will put it on the whiteboard. We can do the math.

That is at EmpoweredWorth.com. Are you ready for our three rapid–fire questions?

Yes, I am. Let’s go.

Vicky, tell us one super tip on getting started investing in real estate.

Know your area, location. I personally believe in invest in the areas that you know either because you grew up there or you live there.

What is one strategy for being successful in real estate investing?

I say this to everybody. I say this when it comes to finances. Don’t be emotional. Be financial. Don’t take it personally. I know people put their blood, sweat and tears into these houses and making them perfect. If someone walks in or a realtor walks in and goes, “You made a mistake.” Don’t listen to them. Trust your gut.

Vicky, what would you say is one daily practice that you do that contributes to your personal success?

I love yoga. I have taken up yoga in 2020. It was something that got me through a lot. It has helped me. The best thing about yoga is the silence, meditation and being able to center me because there is a lot of noise in our lives. We need to connect with ourselves in a very spiritual, meaningful way. It’s not financial. It’s yoga.

A lot of people say that. They say yoga, meditation. That is fairly common. It’s good to realize that, ladies. In order to be successful in real estate or in our businesses or as moms or as anything, we need to take care of ourselves. We need some downtime where we are all about us. That is important. This has been amazing, Vicky. Thank you so much for what you have offered in this portion of the show.

Thank you for having me and for giving me this opportunity to connect with your readers to talk about how important real estate investing is. It’s where a lot of us get our start when we start investing before we even jump into the stock market. It is an important part of every portfolio.

Thank you for that. Ladies, we got more. We are going to be talking about the financial consequences to women from COVID and what are those long–term repercussions going to be? We are going to be talking about that in EXTRA. If you are subscribed, stay tuned. If you are not but would like to be, go to RealEstateInvestingForWomenExtra.com. You get seven days for free. Check it out and stick with it if you love it. The other thing is you can connect with me and find out everything that I’m doing at BlissfulInvestor.com. There is a free report there. There is the show. That is my website. Ladies, if you love this show, help out all the ladies in your life and tell them about it.

This is the most meaningful thing that I do and the reason I do it is because of the emails and reviews that I get. I’m talking out into the ether. I don’t know who is reading. When I get responses back about, “Moneeka, you started my investing life. I’m so excited. Moneeka, you changed my life because I finally bought a property after thinking about it for a few years.” When I get these letters back, it fills me up. We are making a change in the way women see the world. If you want to support other women that you love, tell them all about the show and have them read the blog post. Hopefully, you will be a letter to me soon too. Go to BlissfulInvestor.com and tell all of your lady friends about the show. If you are leaving now, thank you so much for joining us. You know how much I appreciate you. Always remember, goals without action are just dreams. Get out there. Take action and create the life your heart deeply desires. I will see you soon.

Important Links

- Empower Your Worth: A Woman’s Guide to Increase Self Worth and Net Worth

- www.EmpoweredWorth.com

- RealEstateInvestingForWomenExtra.com

- BlissfulInvestor.com

About Victoria Lowell

Born and raised in Florida, Vicky has always been passionate about entrepreneurial pursuits. In 2012, she started her career in finance at UBS Financial Services. By 2017, she transitioned into a financial advisor.

Born and raised in Florida, Vicky has always been passionate about entrepreneurial pursuits. In 2012, she started her career in finance at UBS Financial Services. By 2017, she transitioned into a financial advisor.

Vicky has always been an active member of the community and worked for various entities nationwide. From open and honest conversations within these communities, she discovered the need for women to learn financial planning.

This passion then drove her to enhance her career and advance her education in the immediate and long-term financial implications of divorce as a Certified Divorce Financial Analyst®(CDFA®). She recently was also certified as a College Financial Counselor.®

In late 2018, she left UBS Financial Services to follow her passion and founded EMPOWERED WORTH. Recently, she became an international bestselling author. Her book Empower your Worth, both English and Spanish versions, reaching the Bestseller’s List in various categories and countries. In 2020, Empower Your Worth became a finalist in the Canadian Book Club Awards.

Love the show? Subscribe, rate, review, and share!

______________________________________

To listen to the EXTRA portion of this show go to RealEstateInvestingForWomenExtra.com

To see this program in video:

Search on Roku for Real Estate Investing 4 Women or go to this link: https://blissfulinvestor.com/biroku

On YouTube go to Real Estate Investing for Women

Moneeka Sawyer is often described as one of the most blissful people you will ever meet. She has been investing in Real Estate for over 20 years, so has been through all the different cycles of the market. Still, she has turned $10,000 into over $5,000,000, working only 5-10 hours per MONTH with very little stress.

While building her multi-million dollar business, she has traveled to over 55 countries, dances every single day, supports causes that are important to her, and spends lots of time with her husband of over 20 years.

She is the international best-selling author of the multiple award-winning books “Choose Bliss: The Power and Practice of Joy and Contentment” and “Real Estate Investing for Women: Expert Conversations to Increase Wealth and Happiness the Blissful Way.”

Moneeka has been featured on stages including Carnegie Hall and Nasdaq, radio, podcasts such as Achieve Your Goals with Hal Elrod, and TV stations including ABC, CBS, FOX, and the CW, impacting over 150 million people.

Creating Notes And Doing Good In The World With Laura Gisborne – Real Estate Women

Too often, many people make real estate investing seem harder to get into than it actually is. In fact, for Laura Gisborne, you don’t necessarily need to know everything. You can just start by buying a property, adding value to it, and watching it take you to the next. In this episode, she joins Moneeka Sawyer to help simplify the process for us. As a highly successful business expert with over 20 years of experience from structuring and selling small boutique businesses to owning a multimillion-dollar wine and real estate empire, Laura has the wisdom and insights that could help us find our path towards success. She shares some of those with us and how, more importantly, she is giving back. Tune into this conversation to learn more about creating notes and going the owner financing route, all the while doing good in the world with it.

—

Listen to the podcast here:

[fusebox_track_player url=”https://feeds.podetize.com/ep/pr3dYLub4/media” title=”Creating Notes And Doing Good In The World With Laura Gisborne – Real Estate Women” ]

Creating Notes And Doing Good In The World With Laura Gisborne – Real Estate Women

Real Estate Investing For Women

I am excited to welcome you to the show laura Gisborne. She is a highly successful business expert with many years of experience. From structuring and selling small boutique businesses to owning a multimillion-dollar wine and real estate empire, she has owned nine businesses. Her first, when she was only 23 years old. She is an internationally recognized speaker and serves as a business consultant for business leaders and entrepreneurs in a wide range of industries. The innovative business model of her company, Limitless Women, exemplifies that companies can be both profitable and purposeful.

Through her initiatives, thousands of women and children are receiving regular contributions in multiple countries across five continents. She has served as a Guardian Ad Litem for foster children through CASA, Parent Education Coordinator for Family Outreach, board member for Habitat for Humanity, The New Peaks Foundation, and is on the Business Engagement Team of the Pachamama Alliance. They’re all important and relevant for what Laura stands for, that’s why I wanted to let you know what she’s about around all of this stuff. She is the author of the books, Stop The Spinning: Move From Surviving To Thriving and Limitless Women. She has been featured as a guest expert on both CBS and ABC, as well as on the national bit show, The List. Laura, welcome to the show.

Thank you, Moneeka.

Laura and I are part of a community called The Thriving Women in Business. We met at a luxury retreat with a bunch of other women in Hawaii and hit it off immediately. We have much in common. I wanted to have her on the show to share all of her wisdom with you. Laura, why don’t you start by telling us a little bit about your real estate journey? What’s your story around that?

First of all, thank you for inviting me. I’m super excited to serve you and to help however I may. Ask away whatever questions you’d like to ask. For the real estate journey, it’s interesting. I started back in 1996, I went on a timeshare tour. I don’t know if you’ve ever been on a timeshare tour or not, but it was a fascinating thing. I had no idea what it was. I said to my husband at that time, “We’re not going to buy anything. Let’s go look.” The woman who was our real estate broker, which is like you and I, we hit it off. We had a great affinity right away. The story behind the story is at that point, we had owned three restaurants in Texas.

We sold them and moved to Arizona with the idea we’re going to open up a different kind of business. A bed and breakfast or something that we could do with small hotels. Something we could do while one of us could always be with our children. This woman who sold us a timeshare said, “You should get a real estate license. You’d be great at this.” I said, “I’ve never sold anything in my life.” My background is hospitality and law.” I thought I’d be a lawyer when I grow up. God had another plan to get all these adventures, but that’s a whole other story. It took about two months at the time to get a license if you went full-time.

I got my real estate license. I thought, “This would be a good side hustle to do in the meantime. I’ll get into real estate and do that for a little while, while I’m building my next business.” I started selling, doing well in real estate. I started taking my commissions from real estate sales and buying real estate. Leverage was a beautiful thing back in the late ‘90s, early 2000s. I would buy one piece of property and then get it ramped up and then borrow against that property to buy the next one and so one thing led to another.

It’s intuitive investing. That’s what I did too. I did not become an agent, but once I started buying, I would fix it up, have it increased its value, and then take money out and buy the next one. It’s such an easy way to go. What I love about your story is that it shows women that this thing is possible in an intuitive, flowing way. There’s no magic here. You made some extra income. You decided to invest in property. That property was appreciated because you added value. You take more money out and then you bought another piece of property and just rinse and repeat. What I want ladies to read at this moment is how easy this can be because many people out there are talking about the cool ways or exciting ways to make money in real estate. You could buy everything and no money down. You can do these options and syndication. You don’t have to know all of that stuff. You can just buy a house.

That’s the piece, start with one. My first husband that I got divorced, almost two years after we’d moved to Sedona, I met my current husband. When he and I got married, he moved into my house. We turned his house into a rental. It was that piece. He said, “I can buy you a diamond. I can buy this empty lot.” I was like, “No, buy the lot. Diamonds later. Let’s get some real estate.” It’s a little hedgy. You want to start collecting and our strategy was to cashflow properties. I went to a real estate investing bootcamp in 2004 with John Burley, who was a great guy. Burley looked at what were the different strategies that were working and what works best for us over the years. I would say, it has been that cashflow that we would buy a house and then we would carry the note for somebody who was having a challenge with financing. We do owner finance for them. It worked out great. When they were ready and they were able to qualify, they were able to buy us out and it always became a great win for them too.

If you drive out of the epicenter of your city, the farther you get, the lower the prices of the houses become. Share on XLet’s dive a little deeper into that because that’s not something people have talked a lot about in this show. When we talk about cashflow, usually what people think is you buy a place, rent it out for more than what you owe on it and that’s how you make cashflow. There are lots of different ways to do cashflows. Let’s dive a little deeper into the owner financing route. We haven’t had anybody talk about that. Could you break that down for us a little?

One of the things you always have some questions about is, “What do you need to get started?” Good credit is a great asset. It’s not necessarily the only asset because even if you struggle with credit, you can bring in partners. That’s also been another strategy that was successful for us to joint venture with other investors so that we can pull our money together. We’d put in 10%, they’d put in 10%. We get our 20% down, and we would go in and do a project. That was a whole other side. Generally, we would buy a house. The strategy behind this was that we live in a high ticket area.

As real estate investors, the rule of thumb that we’ve found over the years is that if you drive out for the epicenter of your city, the farther out you get, the lower the prices of the houses become. We’ve always done well with cashflow properties from blue-collar type of families like firemen, school teachers, people that have great jobs. They may not have high revenue, but they have consistent income. They have a good job history. People fall on hard times. I talk about that in my first book. I went through my journey when I got divorced. It didn’t make my life easy with my credit. I made some mistakes, but I cleaned them up and was able to move forward.

When somebody’s gone through some life situation like death or divorce or disease, you can look at their credit and find out, “Was it an isolated time? Do they have a better history before?” Banks are not always forgiving, but as a lender yourself, you can be forgiving. You can find those people that you trust and work with them. A lot of times, that gives them the opportunity to get into a house, and our structure was, let’s say somebody who normally would pay $1,000 for rent if they were doing a lease option which is the owner finance with us who would have them pay more. Maybe they’re paying $1,300 or $1,400 a month, but a portion of that would be going towards the purchase of the property.

If they could get it together and then get their own financing, which happened for every house we ever had in Arizona, they always ended up cashing out which was great. You think as you keep them as high ticket renters for a long time, but the goal is to help others get into their own homes. You figure out a price, you buy your house for $100,000 and you decide to sell it to them for $120,000. They live there for a few years, pay the rent, and because they had an ownership in the property, they would take better care of the property first and foremost. They wouldn’t call you for every like, “I need a new light bulb,” because it’s their property. They had pride in that.

Did you get a down payment and what percentage would you normally get?

It depends on where they were. That’s the idea too. I know a lot of people that do resell houses with no money down and 4 or 5 high ticket leases. Our intention was always to have a win for them and have them be able to get to a place that they could afford.

You did take some down payment so they felt like they had bought?

Let’s say that you’re doing a security deposit on a rental. You do first, last and one-month security on a $1,200 property, that’s $3,600. Over time, they came up with $5,000. We didn’t charge them much more. The round numbers we love working-class neighborhoods as families. Those are the ones that get the hardest hit when the economy goes south.

Stop The Spinning Move: From Surviving To Thriving

With a lot of the owner financing that I’ve seen, they’re structured a little bit differently. What kinds of percentages do you normally give them towards their house, for instance?

People that are credit challenged are used to paying a little bit more interest. The interest didn’t come into the equation so much. If I could give you a base rate, it would be like interest rates you’ll see out there is 3%, if I charged 5% or I charge a little bit higher interest rate because it was a higher risk. It was more tied into the lease option.

You would charge an interest rate and everything else went towards paying down their house?

Correct.

Did you normally still have a loan on that property when you did this?

Yes.

That is such an interesting structure. I’ve never seen it like that before.

It worked well for our family and it made us feel good to be able to help people get into houses that couldn’t get in otherwise.

They’re the ones that usually get hit hard when things go bad and it’s not that they don’t want to own homes for their families, nor that they don’t work hard enough for it.

We want to be with people who inspire us, the people who lift us up, and see us when we have a hard time seeing ourselves. Share on XIt’s the idea of 10% down payments. It’s hard for them versus if they can come up with a little bit down and then pay a little bit more each month. It’s like a savings account for them to move towards where they have the equity. The house is also appreciating at the same time. It was all these years in Arizona. When they go to refinance and qualify for a more traditional loan, they’ve got some equity in their other down-payment and they would cash us out.

How quickly do they normally cash you out? How quickly do they normally buy?

It’s an average of 2 to 3 years. That’s in a market where lending was more flexible. We don’t know what’s going to happen after COVID. It’s going to be interesting to see what the banks do. Interest rates are at an all-time-record low and certain things are easier to get financing for than others.

Do you help them with getting their credit fixed if they’ve had any problems or you allow it to season its way out?

No, I think they season. If they’re motivated to buy, to purchase, they know they have to make their payments on time. I’ve met a lot of people over the years when they go all-in on hard times are good people who needed a chance to pull it together and get back on their feet.

One of the things that I love about Laura is her whole outlook on life is she wants to be a limitless woman herself. She believes in time, emotional freedom, financial freedom and true freedom. Being truly limitless and lifting the people around her. She reaches out into the world in many ways whether it’s being on boards of charities or that she finances people in their homes or the way that she coaches her business, coaching clients. Everything that Laura does, her aim is to lift those people around, to be better off than they were before.

Part of what struck me about Laura in the very beginning when I first met her is she’s always, “How can I be a service for you? What can I do at this moment to help you?” She comes from this place that I call one of my bliss tenets, which is to give back to the world, to be of service. When we’re out there and serving, it’s hard to feel bad inside. We’re being of service, but it also fills us up. It gives us more to think about, to do, to feel good about. It also helps us to raise the vibration around us because anybody who then is going to come around us are going to be people that have that same vibration, intention, and blessed in their life. Wouldn’t you say?

I would. I went to a yoga class right before you and I have this interview. I was listening to a sermon on the way. One of the things he was talking about was how much we can be around people that pull us down and how important it is for us to always surround ourselves with others who lift us up. I feel like I’m hearing it twice. God must be giving me a message. This idea of who we surround ourselves with is important. We want to be with people that inspire us, that lift us up and see us when we have a hard time seeing ourselves.

That’s kind, generous and uplifting. I know much of the time when I’m not down as often as I had been. A lot of my journey to bliss was because my life experience was very unhappy. We often focus on the things that have challenged us ourselves. I remember learning early on this thing that everybody says, you become the five people you spend the most with. It sounds trite. The truth is the most time that you spend with people, those are the people that are going to influence you the most. It’s important that you decide who you want those people to be and you do have control over that.

Creating Notes: Banks are not always so forgiving, but as a lender yourself, you can be and you can actually find those people that you really trust and work with them.

We don’t have control over the family and don’t dump your family. You don’t want to do that. You want to make sure that when you’re out there in the world, when you have the choice, you’re choosing people who are going to support the joy in life, help to uplift you and support your values. I can’t imagine Laura ever hanging out with someone that did not believe in philanthropy.

It’s not a new journey for me. The work that I do is all about business training, to lift women so that they can use their profits for purpose. All of that’s come as a typical overnight sensation. I started volunteering many years ago. While I was building my private sector life, our restaurants, our retail stores, our real estate and our wine business, I was always volunteering as a separate. I felt like I had one foot in either world. I had a private-sector world and my volunteer world. What’s been beautiful is over these last few years, we put our stake in the sand and made our whole business about fundraising and raising awareness.

Even prior to that, even when we were percolating this business starting about 2012, that was always a common theme. We’re good. We’ve raised our children. We’ve traveled the world. My husband had a terminal diagnosis many years ago and now he is healthy and on track. We’re thrilled. We try to celebrate every day that we get to have together. For us, the motivation is not about how do I make more money. I’m more curious about how I can use my experience and my voice to lift up other women that they can find sufficiency and freedom for their families, and then join us in the contribution phase. What we know from experience of doing this work now is it’s difficult for women to see themselves as philanthropists and givers when they’re struggling financially. We need to help them get to sufficiency first.

You and I both started at a place where we weren’t in a financial place that people would normally think of us as givers. I started my philanthropic journey when I was sixteen living in India. I didn’t have a lot of money and we started to volunteer time, and a little bit of money for me. It was $10 a month. It’s important that we feel lifted up enough. You don’t want to give when you don’t feel like you have. You never want to give them more than you feel you can give. That is true whether it’s of your heart, time, or money.

There’s a little paradox in that for me only because it’s my understanding and my core premise at this point in my mid-50s. I grew up in a very poor family. I did not have access to resources and no one had ever been to college. It was that whole idea of education and freedom. It wasn’t something that we had access to and didn’t know that access. My parents did their best to ingrain in me. I can do attitude and willingness to work hard. I’ve always been a good student. I’ve got a lot of gifts and a lot of things that have come through that helped me again when I couldn’t see myself.

The most successful people that I knew and that I’ve had the blessing of knowing throughout my journey at this point are people who were always generous of heart, generous of spirit. It wasn’t someday when they got wealthy that they gave. It was getting through the stretching through the expansion. There’s something in that for us. I believe that giving causes growth. It’s an interesting paradigm when women come to one of our programs and they want education on how to build a business. I asked them to make a donation in exchange for your education. There’s often a little hesitancy if that’s a new paradigm for them. They haven’t done it before. I say, “If you can afford to invest in yourself here, you can afford to give there.” What it does is it starts them being expanded. This is either they can, then they start being a whole different level of leader.

We’re saying the same thing. I feel that women often over give. In their homes, they say yes too often. That’s more of what I was referring to about, we do need to keep ourselves filled up emotionally, internally, and mentally so that we can then stand in our power in the world. What’s also funny is that you will never expand until you understand that being of service is the most important thing. When you are able to start to understand that, then you expand in every way. You expand emotionally in your capacity to give, your compassion, wisdom, personality and also wealth.

My husband learned something from me very early on. We were broke as newlyweds. I remember one day, we were talking about the budget and I said, “I still have to donate to the temple.” He says, “We pass on it this year.” I said, “No. We’re going to double it this year,” which frustrated him. For me, when I start to close down, to cringe, feel that I can’t do it, is when I open up even more because then that releases all of that. Now, money, energy and creativity start to flow.

It sounds like it’s your story. It sounds like it’s your truth.

If we've been blessed to have an opportunity to do well for ourselves, who else can we help so that they can do the same? Share on XDo you find that’s also true for other people?

It depends on where they are. There’s some truth in Maslow’s hierarchy of needs. When somebody is in survival mode, I’m always in awe, when I meet people who live on less than $3 a day, who find a way to give. There’s a place where a lot of times there’s a spiritual component that kicks in. Most people that I meet in the developed world are still running the myth of not enough, but they’re still trying to be more, do more, have more. Yet, if they can’t overcome that, then my conversation is not the right conversation for them. If they’re stuck in that, then all we can do is love and try to support them as much as we can with where they are.

What do you mean by a limitless woman?

Monica Nyiraguhabwa, who you’re familiar with, is also a donor for Girl Up Uganda through Kimberly Writing Women In Business Giving Circle. When I met this woman who’s in her mid-30s, I started to learn more about her story. She’s incredibly humble. You don’t know that until you start getting in there and digging in. She grew up in the suburbs of Kampala. She had her first pair of shoes at age thirteen. People may or may not know this, but in most places in the world, education is not free. She had to come up with school fees.

Her parents had to decide, “Do we send our son or daughter to school?” They decided to send their son because chances are, he would stay in the village versus her getting married and moving away from the village. She was resourceful. She started selling vegetables. She found a way to make her school fees. She started this at about age seven. It was mind-boggling to me. She went on the Government of Uganda partnered with the University of London and created a scholarship fund for five students in the entire country. There were 5,000 applicants. She was one of the five students who got the scholarship, went to England, stayed on for a Master’s degree in Public Policy, and then came back to Uganda to the slums. I mean no electricity, no water, no roads, no transportation, and decided to dedicate her life to lifting up other young women.

They wouldn’t have to be in a family where a family had to choose. That to me is a limitless woman. Everything that was presented to her was what we would consider I believe a limitation and she chose not to see it that way. She chose to stay deep in her faith to keep taking the next step that she could. She’s an Obama scholar, spoken to United Nations, on the Today Show. She’s right there in Uganda, in the trenches, making a difference for hundreds of thousands of girls. A lot of times when we face adversity in our lives, things that could be in way, perspective is important. For me, there’s nothing at this point in my life that makes me more excited than supporting a woman like that who’s out to change the world.

That was an amazing story. Thank you for sharing it.

She’s a limitless woman. That to me is the epitome of a woman who overcomes amazing adversity. An ordinary girl with extraordinary faith and perseverance. She chose not to just make it about herself. She has nine adopted daughters. She’s 36 or 38. She’s my relevant hero. I have many of them. It’s this work of how do we, as women, lift each other up? How do we as women continue to shift the idea that there’s any competition? There’s no competition. There’s a tremendous amount of abundance in the world. There’s a tremendous amount of resources.

If we’ve been blessed to have an opportunity to do well for ourselves, meaning that we’ve reached sufficiency. We’ve been able to take care of ourselves, our families. Who else can we help so that they can do the same? My family of origin could not help me past a certain point because they didn’t have any reference. They didn’t have any perspective. There were other people who saw me from the outside who said, “You can do this. There are other possibilities. Somebody has to open up and shine a light on what’s possible.” I feel like I’ve been very blessed. All the way plus up to this point, and as long as God lets me stay here. It’s good to be here.

Creating Notes: The epitome of a woman who overcomes amazing adversity is in being an ordinary girl with extraordinary faith and perseverance and choosing not to just make it about herself.

Laura, how can people reach you if they want to get in touch with you and find out more?

The easiest way to get connected with me is through the web. If you go to Free Gift Friday, you can opt in for a copy of my first book, Stop the Spinning: Move from Surviving to Thriving,where I tell my own limitless woman story, where I came from and where life has taken me. It’s a little bit of that journey and the power of the formula. The tools and the resources that I and the most successful women I know used to keep themselves on track financially, with the time, their operations, and community. You can always contact me through the website, LimitlessWomen.com. There’s a Contact Us form that comes right to me.

Ladies, I would go there and get that book. That sounds amazing. I know I’ll be doing that. Laura, are you ready for three rapid-fire questions?

Yes.

Give us one super tip on getting started in real estate investing.

One of the fastest ways that you can grow your real estate business is to get comfortable with using other people’s money. When you think like an investor, you look at how the profit on a property is made when you buy it, not when you sell it and you get clear about your numbers, metrics which all are part of the education. You can bring in business partners because everyone will run out of their own money at some point. If you want to keep growing, you want to keep expanding your business. Learn early on how to make it a win for other investors. A lot of people don’t necessarily have the time or inclination to get an education. If you’re one of those women who’s motivated by giving the education, understanding how to do this, and you partner with someone who’s an investor, who wants to get a good return on their investment, but they don’t want to have to do all the work, that’s probably the best super tip that moved us the fastest.

What would you say is a strategy to be successful as a real estate investor?

You have to get clear about what your revenue-generating activities are. If you’re not writing offers on houses, connecting with investors, and bringing in joint venture partners, not advertising your properties and finding leases, you’ve got to get clear to where are the actions that drive your revenue, not shopping. Shopping as fun as that is, that’s not always the best thing to be spending your time on. Get clear about your paradigms. Get your education in place, and then get into the actions that going to bring in revenue to your company.

What is one daily practice that you would say contributes to your success?

One of the fastest ways to really grow your real estate business is to get comfortable using other people's money. Share on XI’m a very faith-based person. A lot of conversations with God throughout the day and I never say never. Almost every day, I don’t get out of bed without a deep gratitude practice. I have an incredible amount of blessings. I’ve overcome an incredible amount of adversity by American standards. At the same time, I know that we get more of what we focus on. I’m constantly in prayer and gratitude for all the good things that are happening. I’m open-minded and allowing myself to be led to what the next step is.

I love how you talk about that. You’ve had a lot of adversity according to American standards. Let’s keep it in perspective.

As a child, I was sexually molested. I experienced a tremendous amount of abuse and domestic violence relationship in my late teens. This is the piece, not that those things weren’t hard. They were very hard and I always had a roof over my head and I had fresh water. Now, the perspective I have after working locally in charity projects humbles me. It tells me what people are capable of creating and achieving with little in the way of resources. I’m inspired to see how many of them I can continue to support.

Laura, I loved this conversation. Thank you for what you’ve offered to my ladies.

It’s my pleasure. Thank you for having me.

Ladies, thank you for joining Laura and me for this amazing limitless conversation. I look forward to seeing you next time. You know how much I appreciate you. Always remember, goals without action are just dreams. Get out there, take action, and create the life that your heart deeply desires. I’ll see you soon.

Important Links:

- Stop the Spinning: Move from Surviving to Thriving

- Limitless Women

- The Thriving Women in Business

- Monica Nyiraguhabwa

- Free Gift Friday

- LimitlessWomen.com

About Laura Gisborne

Hey! I’m Laura

An entrepreneur, philanthropist, writer, wine maven…

And fierce advocate for helping brilliant, passionate women like you mobilize their richest gifts into a business they adore that transforms lives and the world around them.

Working with me, you escape working harder and harder just to feel “good enough.” You shed the frustration of not being where you thought you’d be by now.

And instead, start living your greatest purpose. Far faster and with far greater ease, clarity and power to do good than you ever imagined possible.

Now, just in case you’re thinking “Sure, Laura, easy for you to say. You’ve already got the luxury of freedom and time. You’ve already got a string of successful businesses under your belt.”

To listen to the EXTRA portion of this show go to RealEstateInvestingForWomenExtra.com

To see this program in the video:

Search on Roku for Real Estate Investing 4 Women or go to this link: https://blissfulinvestor.com/biroku

On YouTube go to Real Estate Investing for Women

——————————————————

Learn how to create a consistent income stream by only working 5 hours a month the Blissful Investor Way.

Grab my FREE guide at http://www.BlissfulInvestor.com

Moneeka Sawyer is often described as one of the most blissful people you will ever meet. She has been investing in Real Estate for over 20 years, so has been through all the different cycles of the market. Still, she has turned $10,000 into over $5,000,000, working only 5-10 hours per MONTH with very little stress.

While building her multi-million dollar business, she has traveled to over 55 countries, dances every single day, supports causes that are important to her, and spends lots of time with her husband of over 20 years.

She is the international best-selling author of the multiple award-winning books “Choose Bliss: The Power and Practice of Joy and Contentment” and “Real Estate Investing for Women: Expert Conversations to Increase Wealth and Happiness the Blissful Way.”

Moneeka has been featured on stages including Carnegie Hall and Nasdaq, radio, podcasts such as Achieve Your Goals with Hal Elrod, and TV stations including ABC, CBS, FOX, and the CW, impacting over 150 million people.

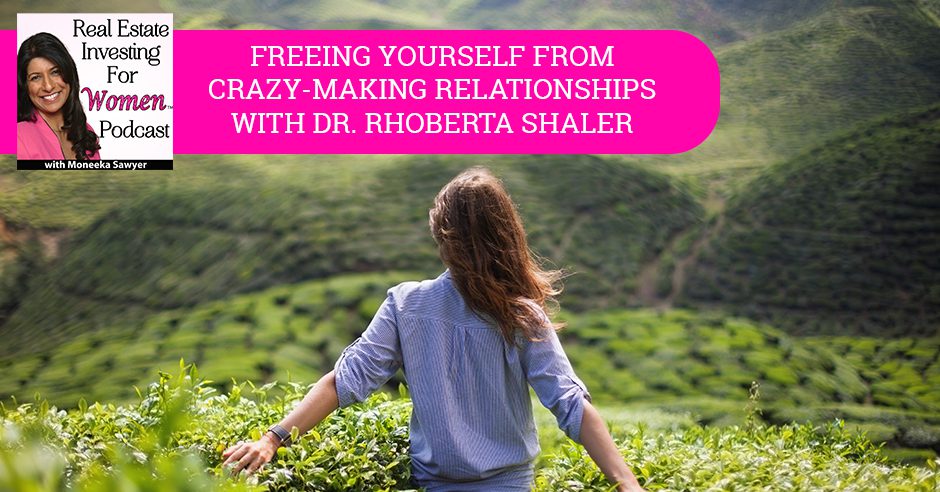

Freeing Yourself From Crazy-Making Relationships with Dr. Rhoberta Shaler

The lockdown and quarantine during this pandemic is sure to make a lot of changes in how people live and interact. There are may even be times that you start to think it may be better to start freeing yourself from toxic relationships. Joining Moneeka Sawyer this episode is The Relationship Help Doctor, Dr. Rhoberta Shaler. She talks about the signs to watch out for in determining if your partner is a hijackal and shares her knowledge on what you can do to improve your relationship. She dives into why it’s important not to run away and instead empower yourself and learn how you can divert potentially intense conversations into the neutral zone and create a safe space for you and your children.

—

Listen to the podcast here

Freeing Yourself From Crazy-Making Relationships with Dr. Rhoberta Shaler

I am excited to welcome to the show, Dr. Rhoberta Shaler, PhD. The Relationship Help Doctor. She provides urgent and ongoing care for relationships in crisis. Her mission is to provide insights, information, and inspiration for clients and audiences to transform relationships with themselves and other humans to be honest, respectful, and safe, and always. Even the United States Marines had sought her help. Dr. Shaler focuses on helping the partners, exes, and adult children of the relentlessly difficult toxic people she calls hijackals. She stopped the crazy-making and saved their sanity. She is the author of sixteen books including Escaping The Hijackal Trap and Stop! That’s Crazy Making. She hosts the popular podcast, Save Your Sanity: Help for Toxic Relationships. Her YouTube channel, For Relationship Help has reached over 350,000 views. Dr. Rhoberta, welcome to the show.

Thank you, Moneeka. It’s great to be here.

It’s nice to see you again. Dr. Rhoberta and I were both Icons of Influence at the New Media Summit. We got to hang out for a few days down in San Diego. It was nice to reconnect. Rhoberta, could you tell us a little bit about your backstory? How did you get into this work?

I started out wanting to be a medical doctor from the time I was five. I was born into a family where I had two hijackal parents and I’m an only child. I had the great joy of having both of them focus on me. They didn’t like each other. It was a very interesting childhood. I learned a great deal. I was very much under the spell of all that had happened to me when I was young as every one of us. I had to do a lot of undoing and a lot of figuring out and there wasn’t a lot of help. Once I got my Doctorate in Psychology, I shifted to this specialty because few people understand what’s going on.

Many times when you go for help with your marriage or your relationship, therapists are not familiar with this. They don’t see it quickly. They do the thing that most therapists would do. They would say, “If you only did more.” In actual fact, that is inappropriate when one of the partners is a hijackal because the other doesn’t need to do more. I am slowly learning all of that. There is a lot of unpacking and a lot of taking the tentacles of my soul, and then learning how to help other people do that. That’s the path that brought me to this particular specialty.

It’s appropriate these days because what’s happening is we’re all stuck together in our houses. Even if they’re crazy about each other and love each other, families are driving each other nuts. It is because we’re not used to be in a close-quarters so much for so long. We’ve got families that even they love each other, they are having trouble. They’re not in toxic relationships but they’re turning into difficult relationships. There are parents that are home with their teenage children or their young children that may not be used to hanging out with them that much. It’s on the same side for the children.

You don't have power over others, but you have power over your own processing. Share on XThe statistic that breaks my heart the most is that domestic abuse has gone up by double digits in the United States. I have 100,000 followers to this show and I hope and pray that none of my ladies or their children are going through those issues. Statistically, I know someone’s going to hear this and be like, “That’s me.” The other piece is there are also toxic relationships and those people are now all stuck together. All of that stuff is what I want to talk about and how to deal with that because it’s such a big deal.

Let me add something to what you said, Moneeka. It could be men who are having hijackal partners too. It’s not just the women. There’s an equal number of male and female hijackals. They present a little differently, but there are equal numbers and they’re equally as disturbing and difficult. It’s important to know, but I’ve done three episodes of my Save Your Sanity Podcast on the topic of housebound with a hijackal because people need strong strategies to recognize what’s going on. You get a little relief when people go off to work, or kids go off, or your mother isn’t calling you all the time and she may be the hijackal or your father isn’t being demanding. The whole idea is that you are in your house and if the hijackal is in your house too, you’re going to have trouble with it. Here’s one big reason why. It’s because hijackals have to be in charge. Imagine how crazy they are without being the one who’s calling the shots.

They don’t get to say if they go to work or not. They don’t get to say if their industry is open. They don’t get to say if they can stay home or not. They’ve been told and they don’t like it. There is a whole bunch of underlying tension and resentment just in the fact that they are not in charge. What that does is it increases their charge and you become more of the target. You are the lightning rod for all of their resentment and the children may get that too. That is going to be very unhappy making and very much less than blissful.

Let’s move with that. Tell us what we can do about it. Give us some strategies to help my ladies if they’re in that situation. The reason I keep saying “my ladies” is because this is a women’s show. I am fully aware that sometimes the ladies are the hijackal. I’m not taking sides. A lot of us ladies know we’re toxic. Sometimes we’re so stuck there and we don’t know how to pull out of it. We feel badly sometimes. Some hijackals don’t see it. That’s true for men and women. Some of us though feel it. We’re seeing it more in the way that we relate to our families now. For those of you, ladies, this conversation is interesting because you get to know what the other side of that is like. Hopefully, you can take some strategies away for yourself on how to be less of that person or get the help that you need.

I understood that but I just wanted everybody to know that if you are a lady and you’re reading this, you could be the hijackal treating your man that way. If you understand that you are treating someone that way and you won’t feel bad about it, it’s highly unlikely that you’re a hijackal. It means that you have learned some coping mechanisms from having been raised with one or previously lived with one. We call it having hijackal fleas. You’ve got some fleas leftover in your behaviors. The fact is that if you are cognizant of what you are doing and feel badly about it and want to change it, you do not have typical hijackal traits. Hijackals are not interested in you. They’re only interested in them and what they can get and how they can have power.